SOLUTIONS

The only banking platform that can make your institution operate smarter

Banking innovation demands precision, not compromise. Kinective empowers financial institutions to revolutionize their entire operational and service ecosystem—from customer-facing engagements to back-office processes and digital interactions.

Our intelligent data-powered operational platform is crafted to deliver unique customer insights, transformative experiences and exceptional efficiencies – allowing you to compete and better serve your communities.

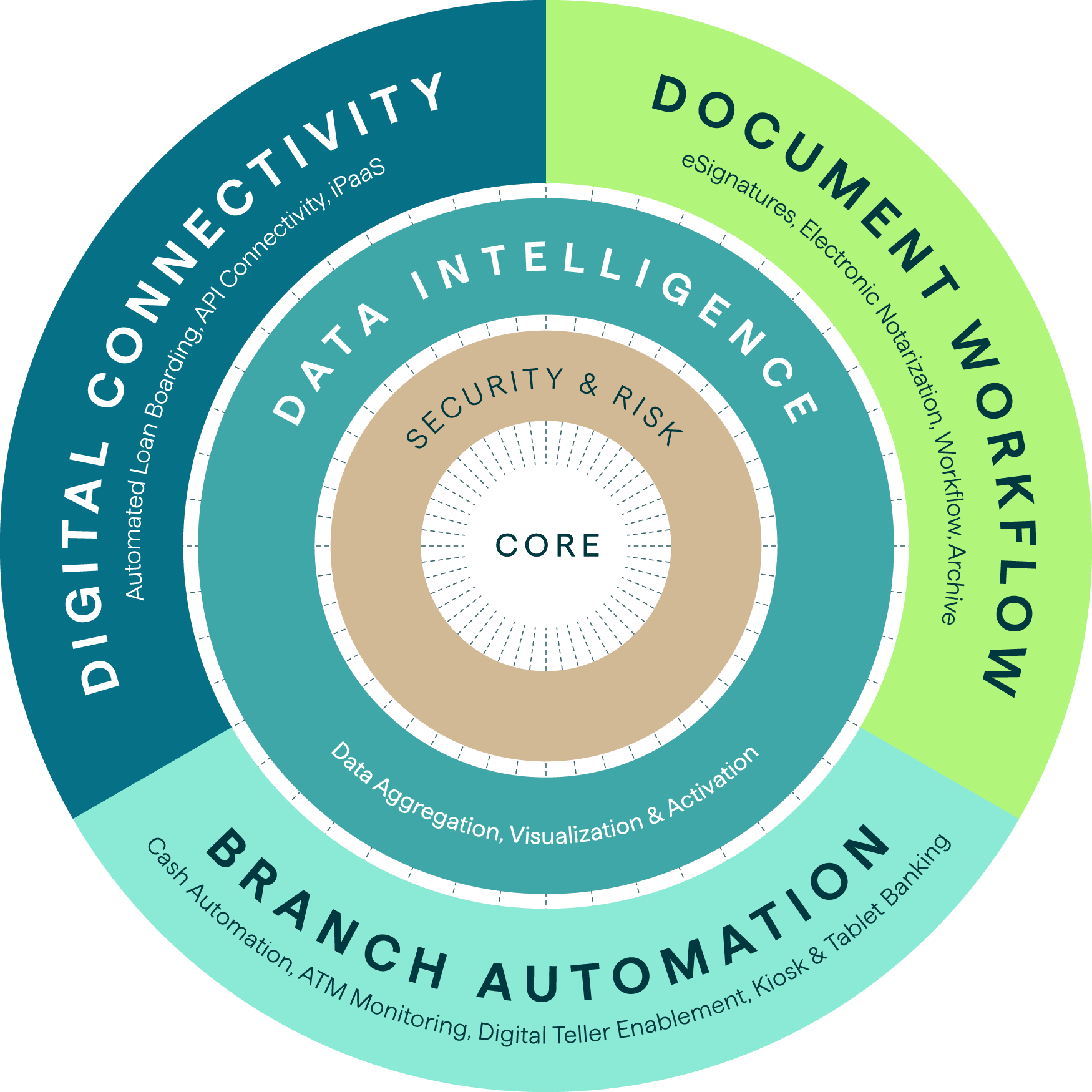

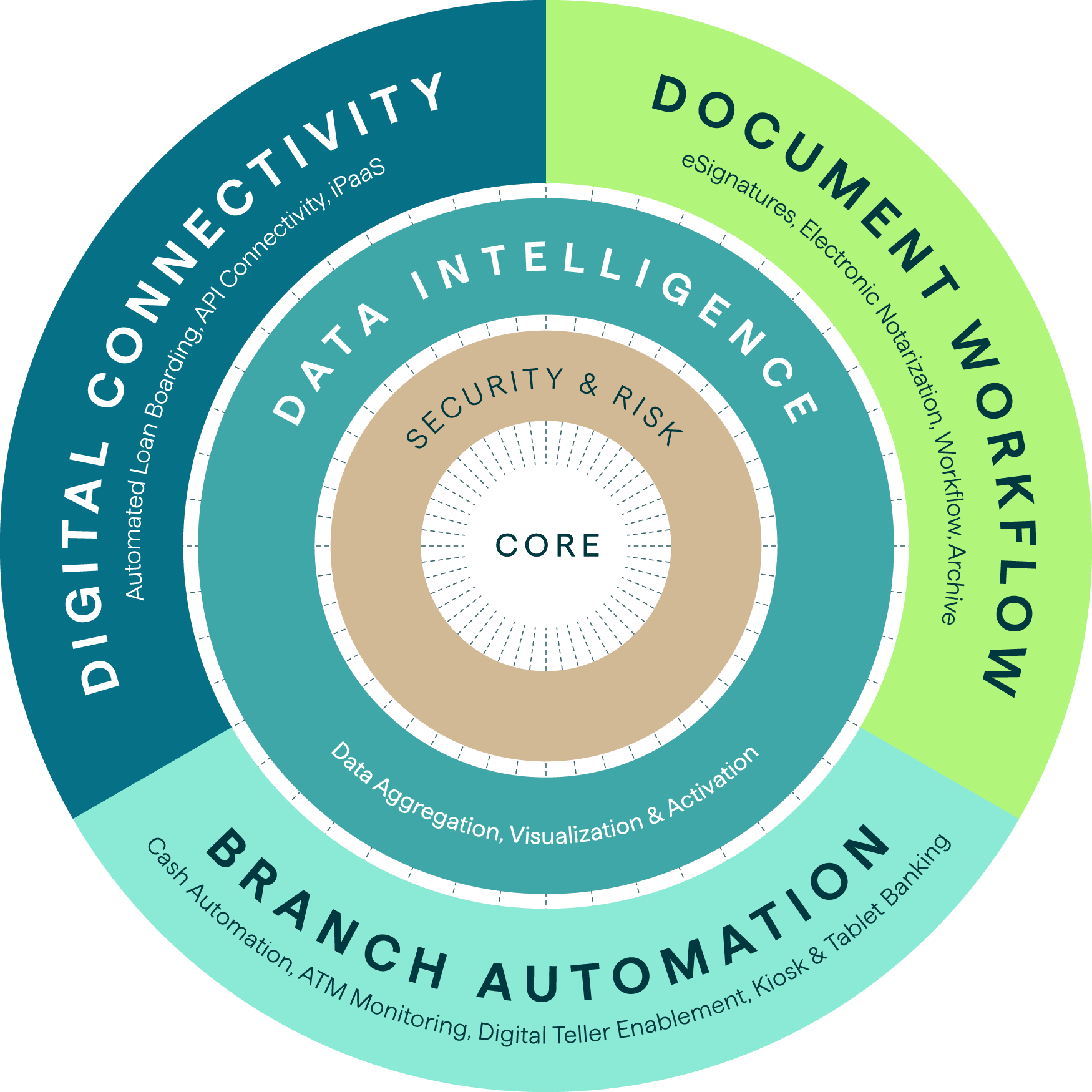

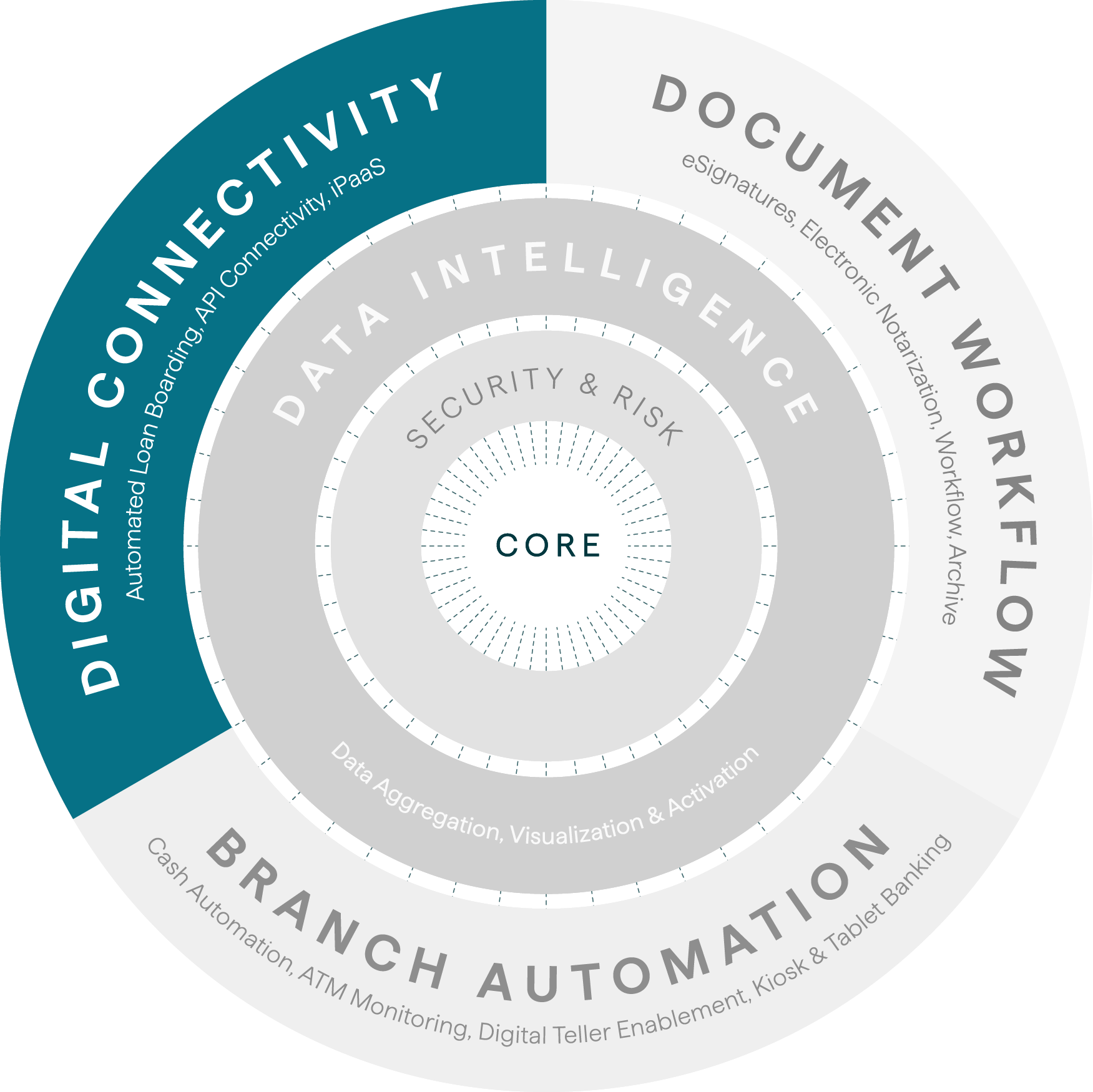

The Kinective Banking Ops Platform

Reimagine your operations, services and customer engagement with the Kinective Banking Operations Platform – powered by data intelligence. Kinective’s uniquely integrated suite provides you with the freedom to choose how you can activate data intelligence, streamline operational processes and deliver better banking experiences.

Automate documents needed to process transactions. Create elevated branch experiences and services. Visualize customer relationships and identify opportunities to grow share of wallet while enabling smarter banking engagements.

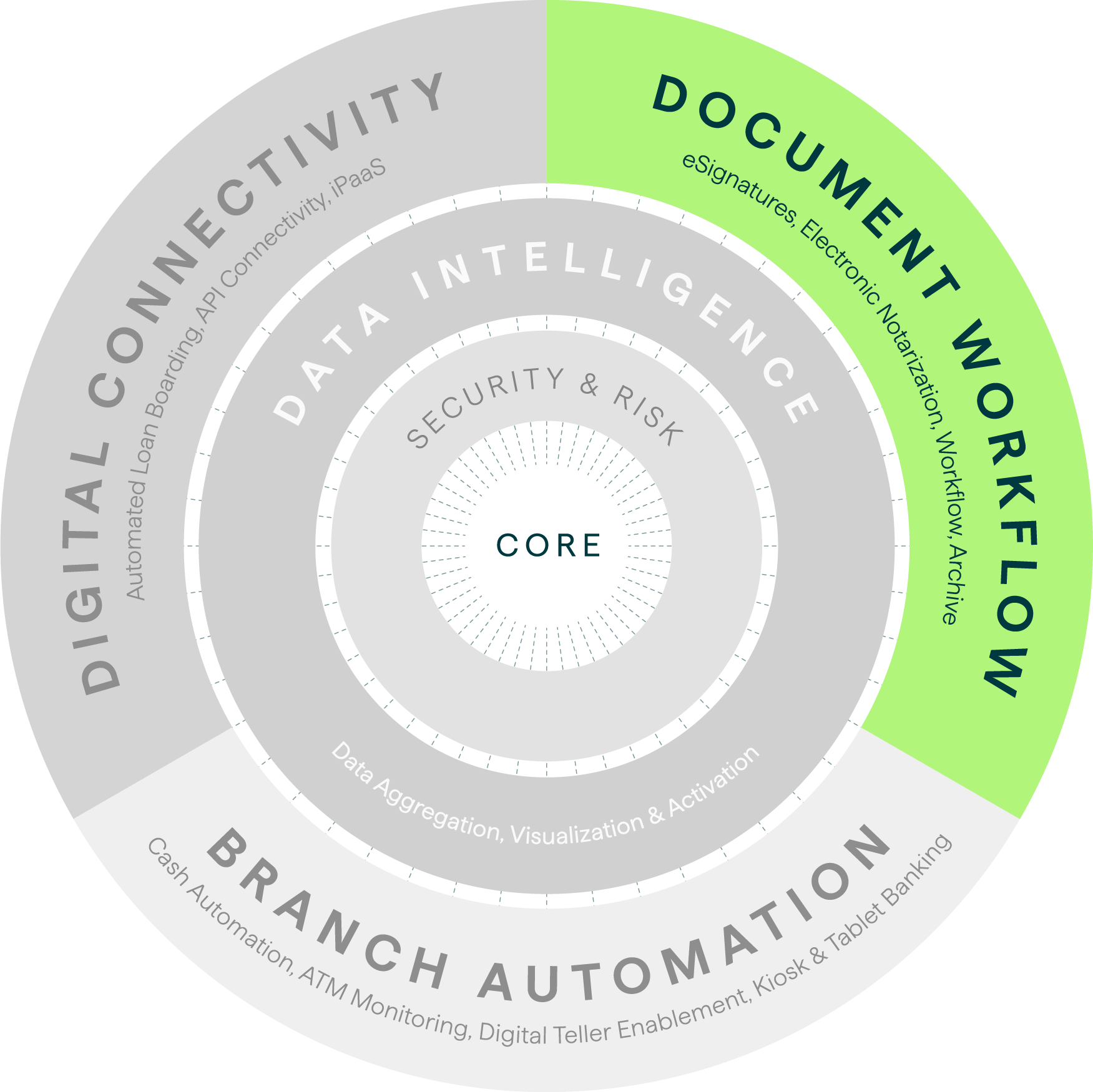

Document Workflow.

Optimize your internal business processes and the way transactions flow across your institution with an easy-to-use, eSignature experience that automates document generation, document execution, and document archiving. End to end connectivity across your institution!

A better way to sign. Built exclusively for Banking!

The most comprehensive eSignature experience in banking today.

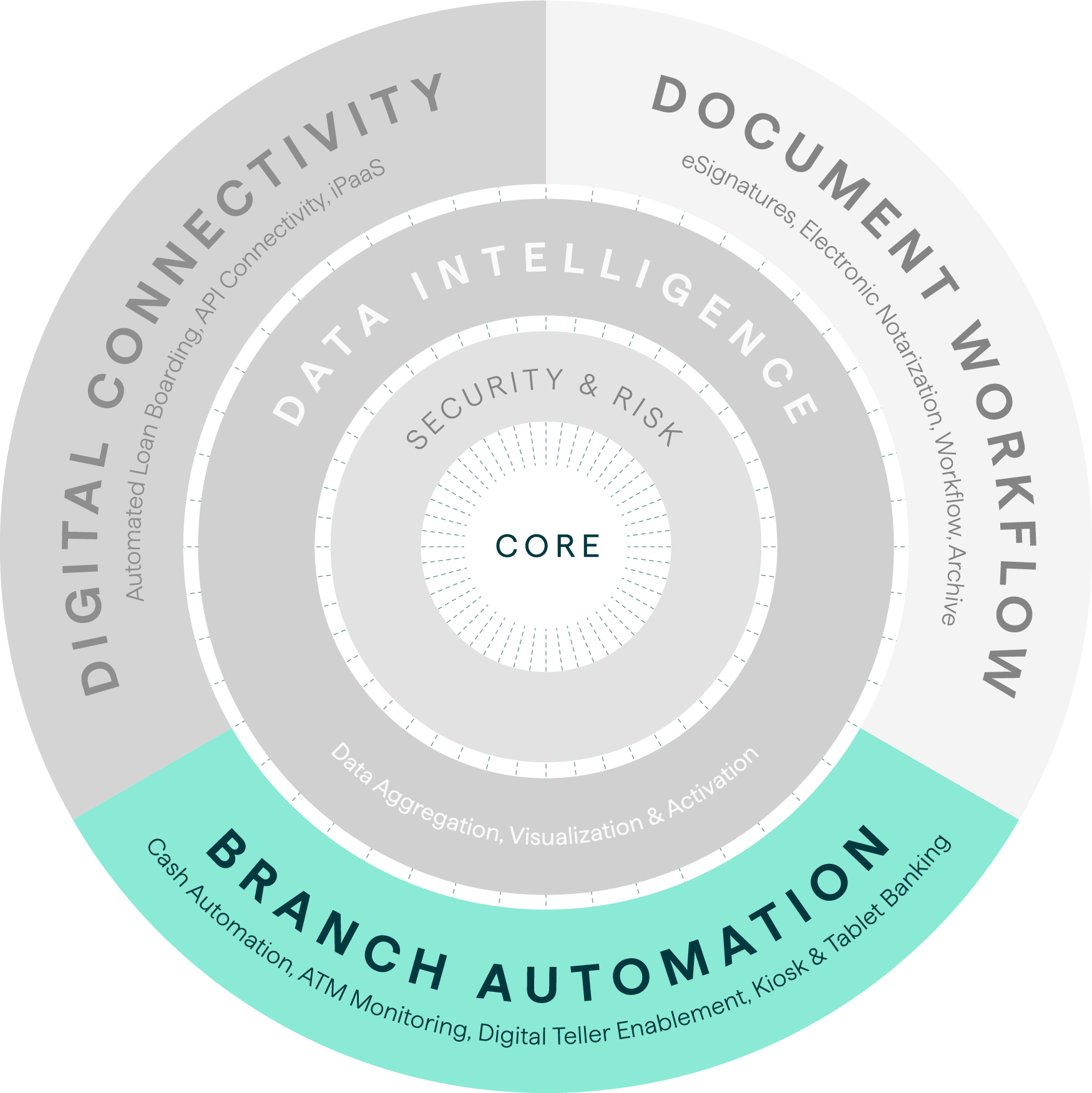

Branch Automation.

Experience the power of streamlined workflows, improved efficiency, and enhanced client experiences with our advanced core integrations with your teller cash recyclers and branch hardware. Real-time transaction processing and automated balancing helps you eliminate labor-intensive, error-prone tasks.

Deliver frictionless digital experiences in branch with our advanced teller enablement solutions.

Kinective Link™ & Kinective Hub™

One connection to power retail banking.

Kinective Access™

Break the chains between hardware and associates.

Kinective Serve™

Transactions from anywhere.

Kinective Kiosk™

Migrate high-cost transactions to self-service.

Kinective Receipts™ & Kinective Receipts Plus™

Next generation digital receipts.

Kinective Check21™

Check21 processing like you’ve never seen before.

Kinective Checks™

Enhance your check flexibility and security.

Digital Connectivity.

Transformation sounds great on paper, but tough to make a reality with outdated and disconnected systems. We have the solution. Our digital connectivity gives you control by bridging the gap between legacy systems and modern digital services through turnkey, best-of-breed API integrations.

Kinective Bridge™

Automate loan boarding to dramatically enhance your loan origination process.

Kinective Gateway™

For Fintechs.

Use one connection to multiple cores and transform your go-to-market solution strategies.

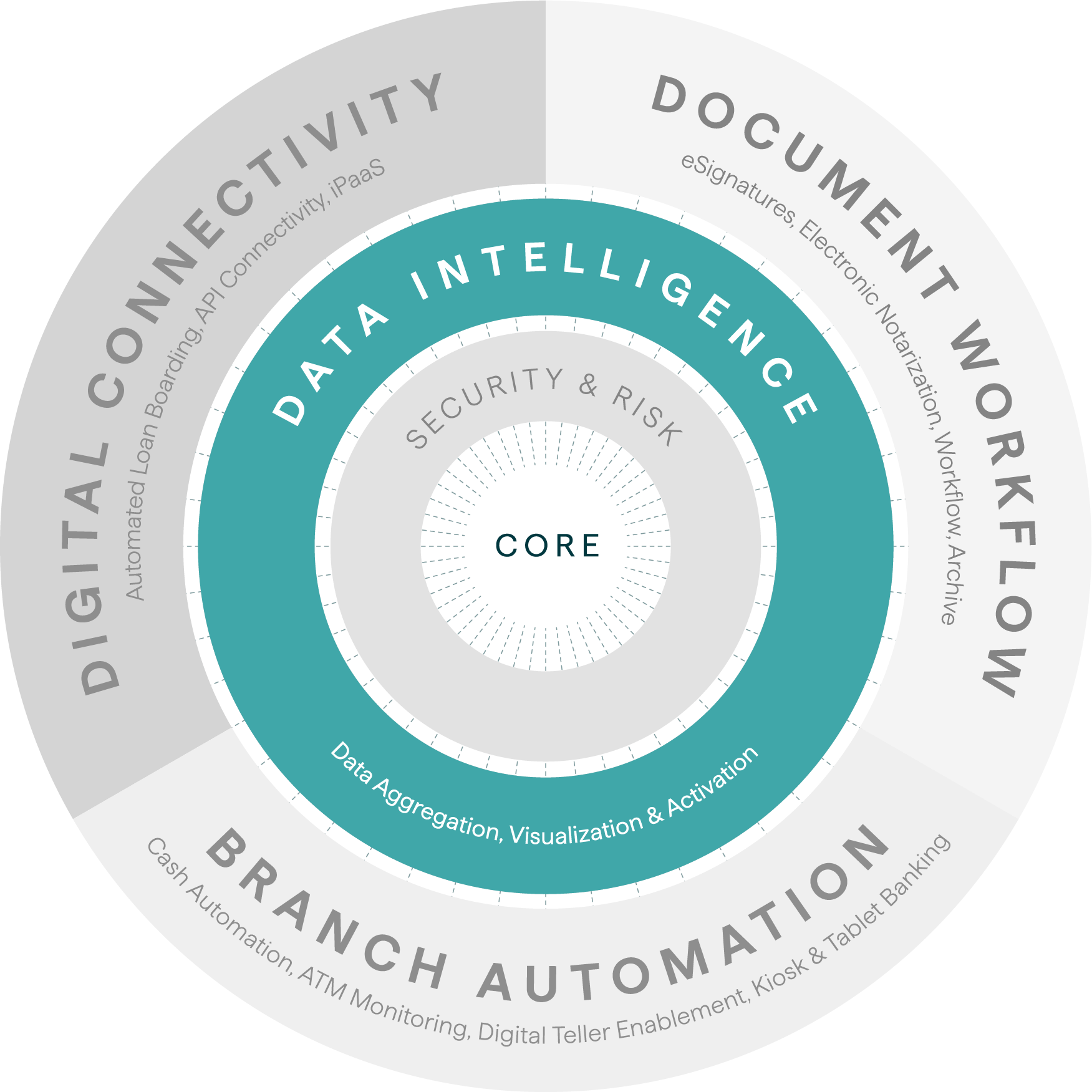

Data Intelligence.

You invest millions of dollars in technology, people, and services each year, but do you know how those investments are performing? Can you easily visualize operational bottlenecks and inefficiencies? Want to get greater visibility into your customers and their relationships?

The newest addition to our Banking Operations Platform activates the data that exists across your institution and in the various systems you use every day. From data aggregation and normalization, to visualization and activation – our data intelligence solutions turn disconnected information into actionable insights.

The result? A pioneering data-driven banking operations platform that changes the way you operate, compete and serve your communities.

Data aggregation, intelligence, and activation that unlocks growth and operational efficiency by managing the entire data journey.

Critical business insights from easy-to-read dashboards.

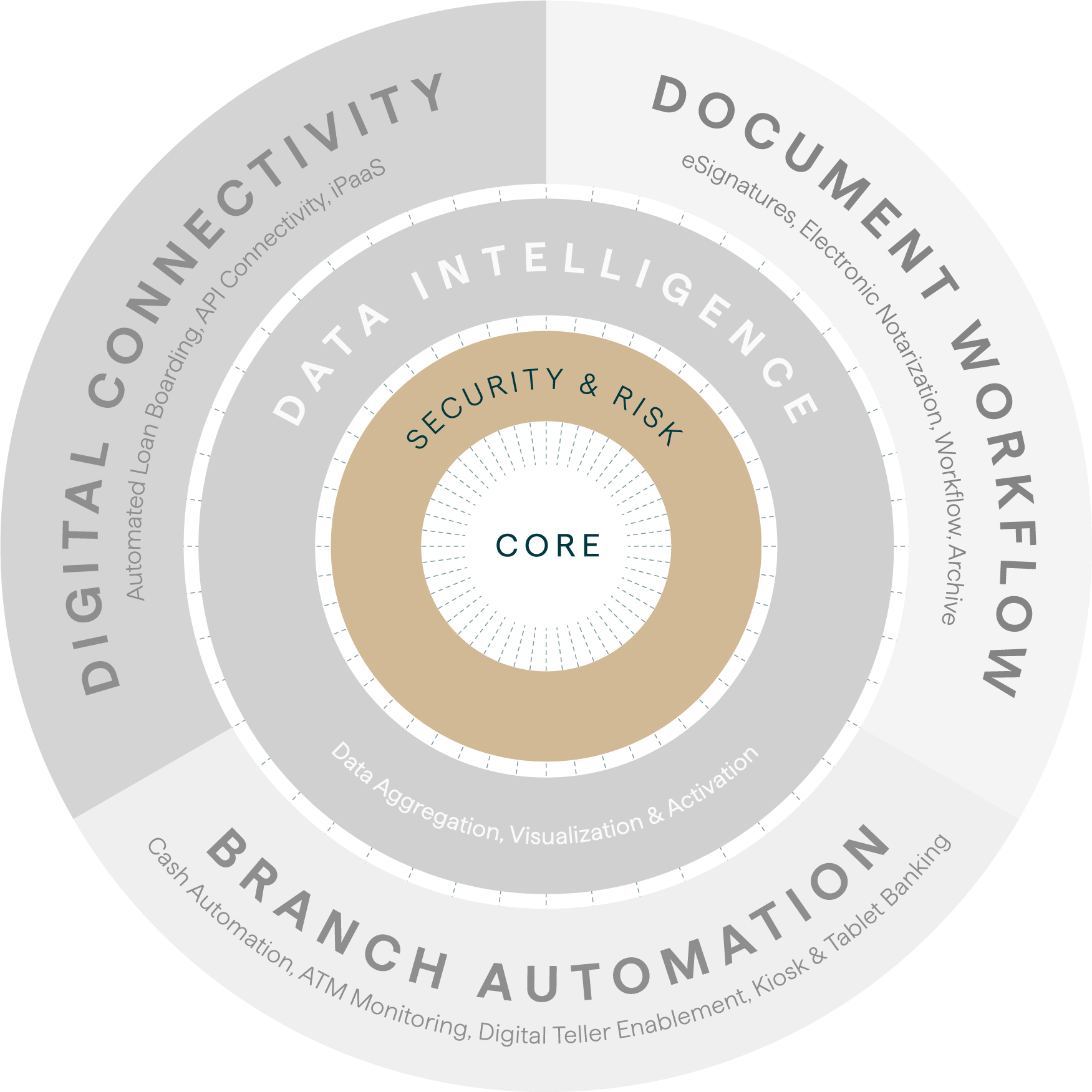

Security & Risk.

Data doesn’t have to be complicated or overwhelming. Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion suite.

Kinective ALM™

Mitigate risk with advanced asset and liability management.

Kinective Migrate™ & Kinective Viewer™

Expedited data migration and imaging without the headache.

The Kinective Banking Ops Platform

Reimagine your operations, services and customer engagement with the Kinective Banking Operations Platform – powered by data intelligence. Kinective’s uniquely integrated suite provides you with the freedom to choose how you can activate data intelligence, streamline operational processes and deliver better banking experiences.

Automate documents needed to process transactions. Create elevated branch experiences and services. Visualize customer relationships and identify opportunities to grow share of wallet while enabling smarter banking engagements.

Document Workflow.

Optimize your internal business processes and the way transactions flow across your institution with an easy-to-use, eSignature experience that automates document generation, document execution, and document archiving. End to end connectivity across your institution!

Branch Automation.

Experience the power of streamlined workflows, improved efficiency, and enhanced client experiences with our advanced core integrations with your teller cash recyclers and branch hardware. Real-time transaction processing and automated balancing helps you eliminate labor-intensive, error-prone tasks.

Deliver frictionless digital experiences in branch with our advanced teller enablement solutions.

Kinective Link™ & Kinective Hub™

One connection to power retail banking.

Kinective Access™

Break the chains between hardware and associates.

Kinective Serve™

Transactions from anywhere.

Kinective Kiosk™

Migrate high-cost transactions to self-service.

Kinective Receipts™ & Kinective Receipts Plus™

Next generation digital receipts.

Kinective Check21™

Check21 processing like you’ve never seen before.

Kinective Checks™

Enhance your check flexibility and security.

Digital Connectivity.

Transformation sounds great on paper, but tough to make a reality with outdated and disconnected systems. We have the solution. Our digital connectivity gives you control by bridging the gap between legacy systems and modern digital services through turnkey, best-of-breed API integrations.

Kinective Bridge™

Automate loan boarding to dramatically enhance your loan origination process.

Kinective Gateway™

For Fintechs.

Use one connection to multiple cores and transform your go-to-market solution strategies.

Data Intelligence.

You invest millions of dollars in technology, people, and services each year, but do you know how those investments are performing? Can you easily visualize operational bottlenecks and inefficiencies? Want to get greater visibility into your customers and their relationships?

The newest addition to our Banking Operations Platform activates the data that exists across your institution and in the various systems you use every day. From data aggregation and normalization, to visualization and activation – our data intelligence solutions turn disconnected information into actionable insights.

The result? A pioneering data-driven banking operations platform that changes the way you operate, compete and serve your communities.

NEW! Datava Data Activation

Data aggregation, intelligence, and activation that unlocks growth and operational efficiency by managing the entire data journey.

Kinective Insight™

Critical business insights from easy-to-read dashboards.

Risk & Compliance.

Data doesn’t have to be complicated or overwhelming. Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion suite.

Kinective ALM™

Mitigate risk with advanced asset and liability management.

Kinective Migrate™ & Kinective Viewer™

Expedited data migration and imaging without the headache.

What do you want to transform?

Seamlessly connect banking cores with modern fintech solutions. No more lengthy overhauls – enhance and extend your existing infrastructure with ease.

Automate labor-intensive workflows for cash transactions and improve teller productivity.

End-to-end automation of each stage of digital document workflow to drive efficiency and customer delight.

Gain unprecedented visibility into operational performance, customer relationships and power smarter engagements through AI/ML predictive modelling and analytics.

Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion suite.

Over 4,000 banks, credit unions, and fintechs trust us.

Case Studies

Real stories with real impact.

Integrations

The largest library of integrated fintech solutions

Press

Kinective in the news.