Intelligent Banking is how FIs grow today.

Discover how Intelligent Banking unlocks capabilities that were previously out of reach for banks and credit unions. Learn the three-pillar framework that helps institutions deliver truly personalized experiences, empower employees with intuitive tools, and surface opportunities before they slip by.

Welcome to the New Era of Intelligent Banking.

Where connectivity, data and intelligence are changing everything.

Over 4,000 banks, credit unions, and fintechs choose us.

The Banking Platform That Changes Everything

Modernize how you operate.

Connect systems across your enterprise.

Activate the data that’s been sitting untapped.

Kinective’s platform brings it all together—so you can transform insight into action and deliver banking experiences your customers and members will remember.

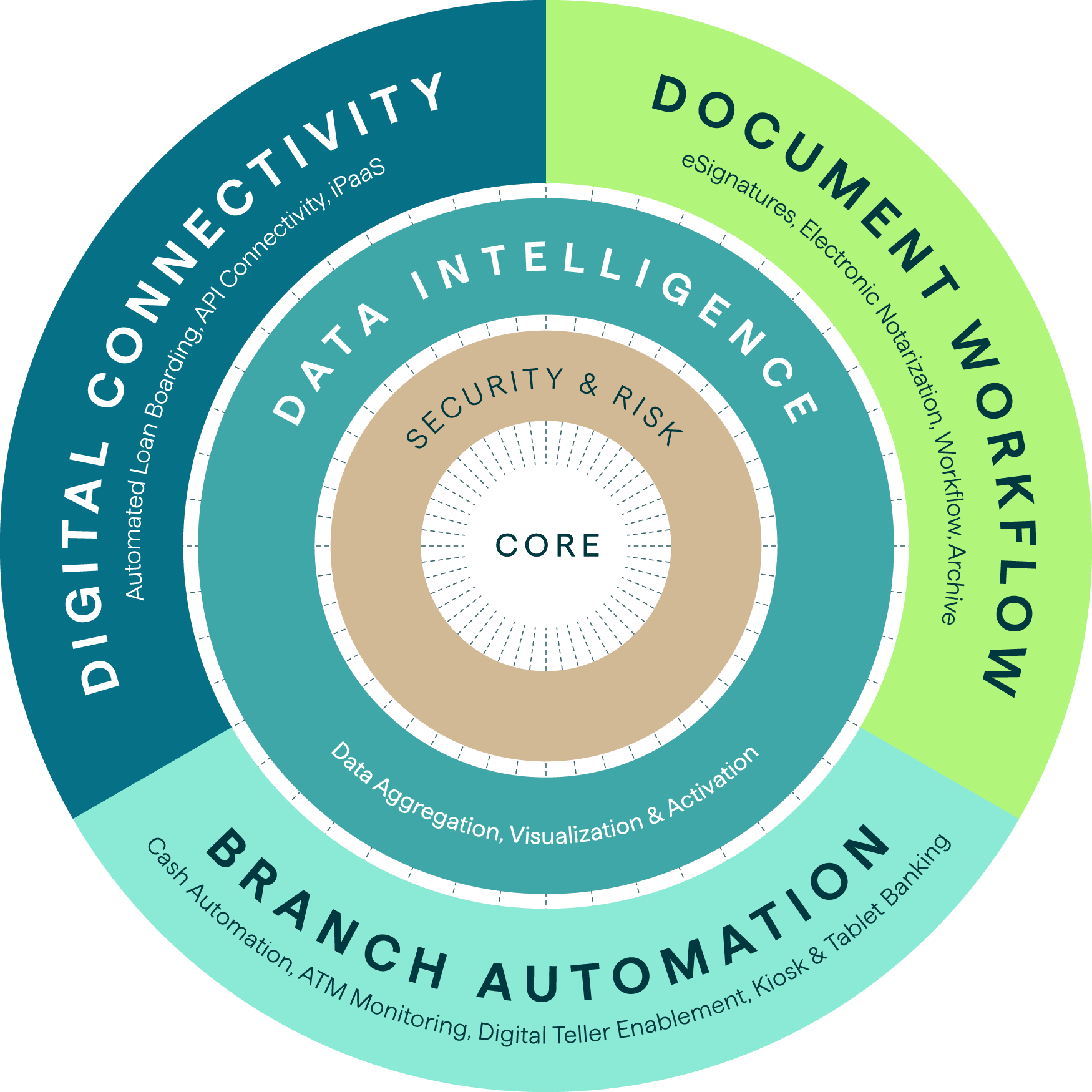

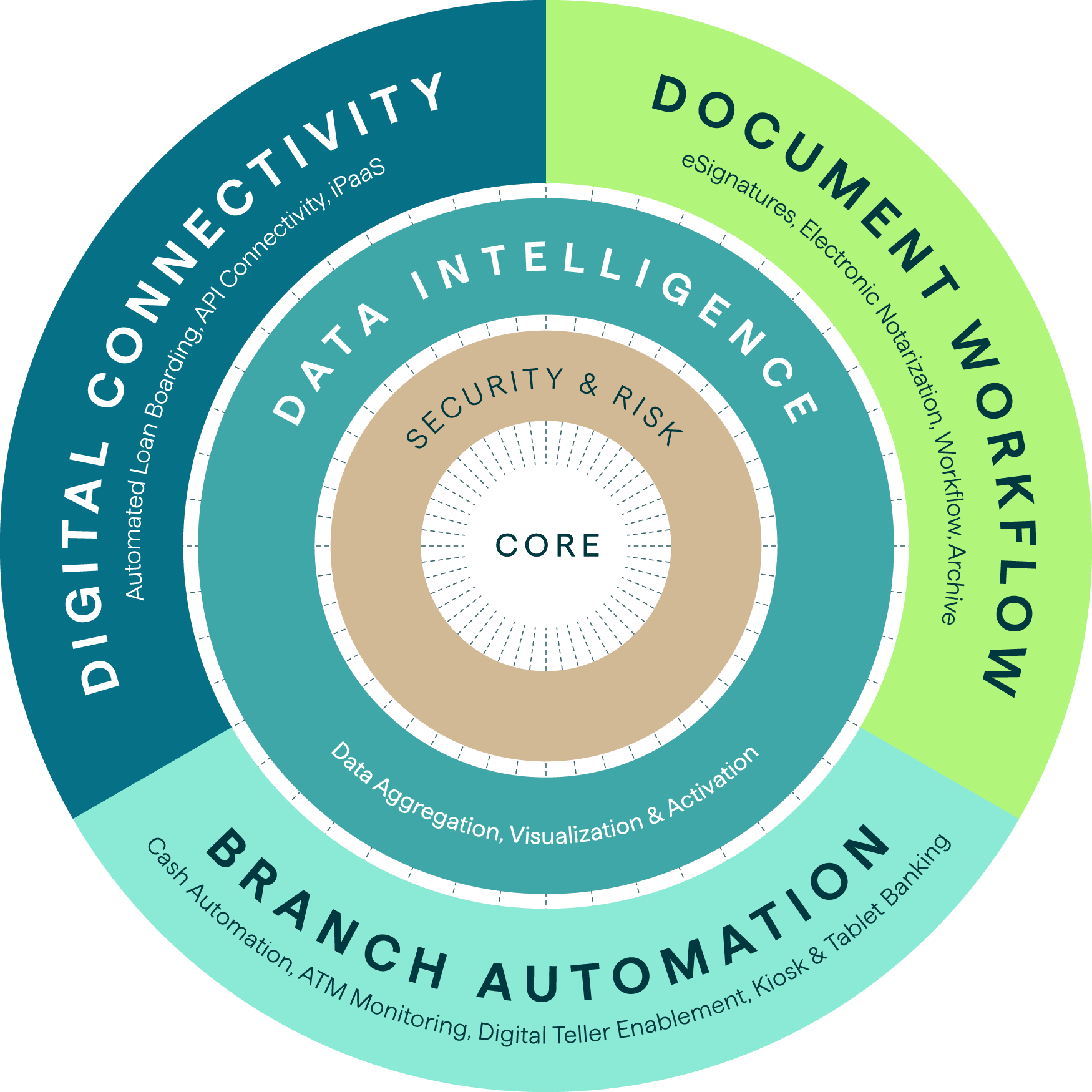

Only Kinective delivers the comprehensive solutions needed to bring Intelligent Banking to life

The Banking Platform that changes everything.

Modernize how you operate.

Connect systems across your enterprise.

Activate the data that’s been sitting untapped.

Kinective’s platform brings it all together—so you can transform insight into action and deliver banking experiences your customers and members will remember.

Only Kinective delivers the comprehensive solutions needed to bring Intelligent Banking to life

The technology brand admired for banking innovation.

For 26 years, we’ve helped thousands of financial institutions modernize operations and transform the way they serve their communities.

4,000+

BANKS & CREDIT UNIONS

Efficiency from intelligent automation combined superior integration.

Accelerate operations and reduce errors with intelligent automation and dynamic workflows that connect seamlessly across your core and fintech applications.

40+

CORE INTEGRATIONS

We were doing so much manual work before, and everything took extra time for our bankers. Now with SignPlus, all our documents go straight to Director automatically, which saves our team a tremendous amount of time. Creating templates is so easy, and the banking expertise and level of support has been hugely beneficial for us—there hasn’t been any delay when we need help.

Kinective Data Intelligence quickly proved its value as an adaptable data warehouse. It expertly ingested and activated our growing data sets, becoming the backbone for mission-critical use cases while eliminating integration bottlenecks and relieving our team’s heavy manual workloads.

Automating incentive tracking has freed up 480 hours per year, letting our management staff focus on coaching and strategy instead of those manual spreadsheets. And as we implement automation for the 5300 call report, we’ll save another 80 hours annually, redirecting time toward analysis and decision making.

Kinective’s Cash Automation solution has eliminated costly dual-entry while empowering our team to focus on high-value advisory conversations instead of time-consuming manual tasks. Their seamless Silverlake integration ensures we deliver exceptional retail experiences every time.

Intelligent Banking for a new era

Banks

Operate more efficiently. Understand your customers more deeply. Deliver experiences that build lasting relationships and drive growth.

Credit Unions

Simplify how you operate. See your members more clearly. Provide personalized services that deepen trust and loyalty.

Fintechs

Launch your breakthrough application to banks and credit unions faster and more efficiently with our pre-built core integrations.

Create personalized moments that matter. Build loyalty that lasts.

BRANCH AUTOMATION

Elevate branch experiences. Make a lasting impression.

Unlock the potential of streamlined workflows, increased efficiency, and elevated consumer experiences with our advanced cash automation, ATM monitoring, digital teller enablement, tablet banking, and self-serve kiosks. Seamlessly integrated with your core systems and branch hardware, these dynamic solutions are designed to transform your in-branch operations and create memorable, customer-centric experiences that set your institution apart.

DOCUMENT WORKFLOW

Move seamlessly through digital document transactions.

Revolutionize your internal processes and streamline document workflows across your institution with a banking-inspired, eSignature experience that automates document execution and routing, with seamless archiving into your ECM/Imaging repository. Experience end-to-end digital processing that delivers the seamless banking experiences your consumers expect, while driving operational efficiency and boosting compliance.

DIGITAL CONNECTIVITY

Connect the enterprise.

Transformation sounds great, but legacy banking systems can make it hard to achieve. Our Digital Connectivity technology is the soluton. These ground-breaking technologies bridge the gap between legacy systems and modern services, empowering you with limitless Fintech integrations with your core. Gain the flexibility and control to deliver new services faster, reduce operational complexity, and unlock the innovation needed to stay ahead in a competitive market.

DATA INTELLIGENCE

Turn information into intelligence with data activation.

You invest millions in technology, people, and services annually—yet have limited visibility into how these investments perform or impact customer relationships. What if you could see beyond siloed systems to understand not just who your customers are, but their complete relationship with your institution? What if you could identify growth opportunities hidden within your operational data? Transform raw data into personalized and actionable intelligence in the very moment that counts.

SECURITY & RISK

Mitigate risk with advanced asset and liability management.

Financial data doesn’t have to be complicated or overwhelming. Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion solutions.