FOR CREDIT UNIONS

Discover opportunity, elevate your credit union.

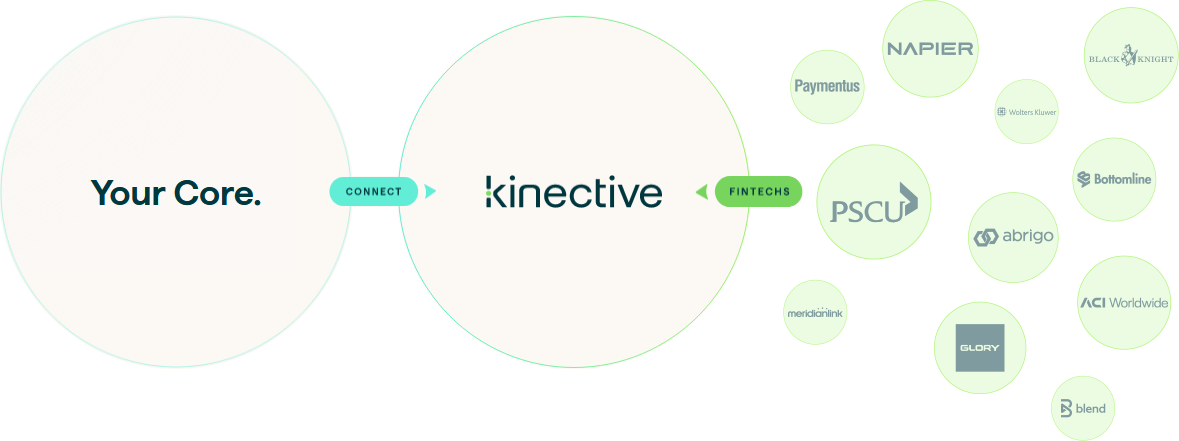

Deliver enhanced member experiences and innovative new products through access to fintech and workflow automation products, compatible with your existing core.

Access an endless set of possibilities.

One connection that helps credit unions differentiate by tapping into a comprehensive library of integrated fintech products.

40+

BANKING CORE INTEGRATIONS

Deliver on increasing member expectations for frictionless experiences.

One connection to integrated solutions that enable enhanced member experiences.

50+

USE CASES INCLUDING ONBOARDING, LENDING, PAYMENTS, TRANSACTING AND MORE

Turn-key solutions for secure, comprehensive, and supported connectivity.

One connection to fully managed solutions that help credit unions realize the full value proposition of their IT investments.

100%

FULLY SUPPORTED CONNECTIVITY

What do you want to transform?

Seamlessly connect banking cores with modern fintech solutions. No more lengthy overhauls – enhance and extend your existing infrastructure with ease.

Automate labor-intensive workflows for cash transactions and improve teller productivity.

End-to-end automation of each stage of digital document workflow to drive efficiency and customer delight.

Gain visibility into performance and device health and usage with our decisioning solution suite.

Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion suite.

Over 4,000 banks, credit unions, and fintechs trust us.

What is fintech?

Fintech, a blend of “financial technologies,” represents the intersection of finance and technology. It encompasses a broad range of technological innovations designed to improve and automate the delivery and use of financial services.

What are fintech companies?

Fintech companies are businesses that leverage new technology to create, enhance, and automate financial services. They range from startups revolutionizing banking to established technology finance firms providing new digital solutions.

Innovative fintech solutions tailored for credit unions.

At Kinective, we understand that credit unions go beyond the traditional structure of financial institutions; they’re community-focused entities that prioritize member needs. Our fintech solutions are tailored to align with this ethos, offering personalized financial services through member-centric interfaces. We provide technologies that facilitate community engagement and enable credit unions to offer bespoke services that resonate with their members.

Our solutions include:

• Customizable financial products that reflect the unique needs of the credit union’s membership.

• User-friendly interfaces that reflect the community values of each credit union.

• Tools that empower credit unions to provide personalized, consultative services.

Optimizing member experiences with advanced technology.

Kinective leverages advanced technology to elevate the member experience at credit unions. For example, your credit union can implement new capabilities that allow members to receive recommendations and insights tailored to their financial behavior and goals. This high degree of personalization enhances member engagement and satisfaction, cementing the credit union’s role as a trusted financial advisor.

Key technologies include:

• Innovative tools for personalized financial advice and product recommendations.

• Seamless digital onboarding processes that make it easy for new members to join.

• Efficient transaction systems that reduce wait times and improve service delivery.

Streamlining operations with integrated fintech solutions.

Operational efficiency is vital for credit unions to remain competitive. Kinective’s fintech solutions streamline operations through integrated technologies. Our API connectivity simplifies data exchange and system integration, making operations more fluid.

Document automation reduces manual processing, leading to faster, error-free operations. Meanwhile, data analytics provide deep insights into operational performance, helping credit unions make informed decisions to reduce costs and enhance efficiency.

Future-proofing credit unions with scalable fintech platforms.

Preparing for the future is essential for credit unions. Kinective’s fintech platforms are scalable and adaptable, ensuring credit unions can meet both current and future challenges. Our solutions are designed to evolve, accommodating emerging fintech trends and member needs. Continuous innovation support ensures that credit unions partnered with Kinective are always at the forefront of financial technology.

Our fintech solutions offer credit unions the perfect blend of technology finance tools to enhance member experiences, streamline operations, and prepare for the future. With Kinective, credit unions can embrace the digital era confidently, knowing they have a skilled and experienced partner committed to their growth and success in the ever-evolving world of financial technologies.