How Forward-Thinking Credit Unions Are Transforming the Teller Experience

Here’s a scene that plays out thousands of times every day in community financial institutions across America:

A member walks into the branch with a deposit and a question—maybe about a home equity line, or whether refinancing their auto loan makes sense.

A teller is available. The teller takes the deposit, counts the cash, counts it again, processes the transaction, waits for the receipt to print, and hands everything back.

“Anything else I can help you with today?”

But the moment has passed. There’s a line forming. The member’s attention has drifted.

The opportunity for a meaningful conversation—the kind that used to define community banking—evaporates.

Now imagine a different version of that same interaction:

The member walks in. A branch employee greets them at the door, asks what brings them in today.

They walk together to a comfortable seating area. The member mentions the deposit—and the question about refinancing. The employee takes the cash, feeds it into a nearby recycler, and the conversation continues. Twenty minutes later, the member leaves with their deposit made and a refinance application in progress.

Same member. Same branch. Radically different outcome.

The difference isn’t better employees or revolutionary training. The difference is that in the second scenario, the technology got out of the way and let the humans do what humans do best.

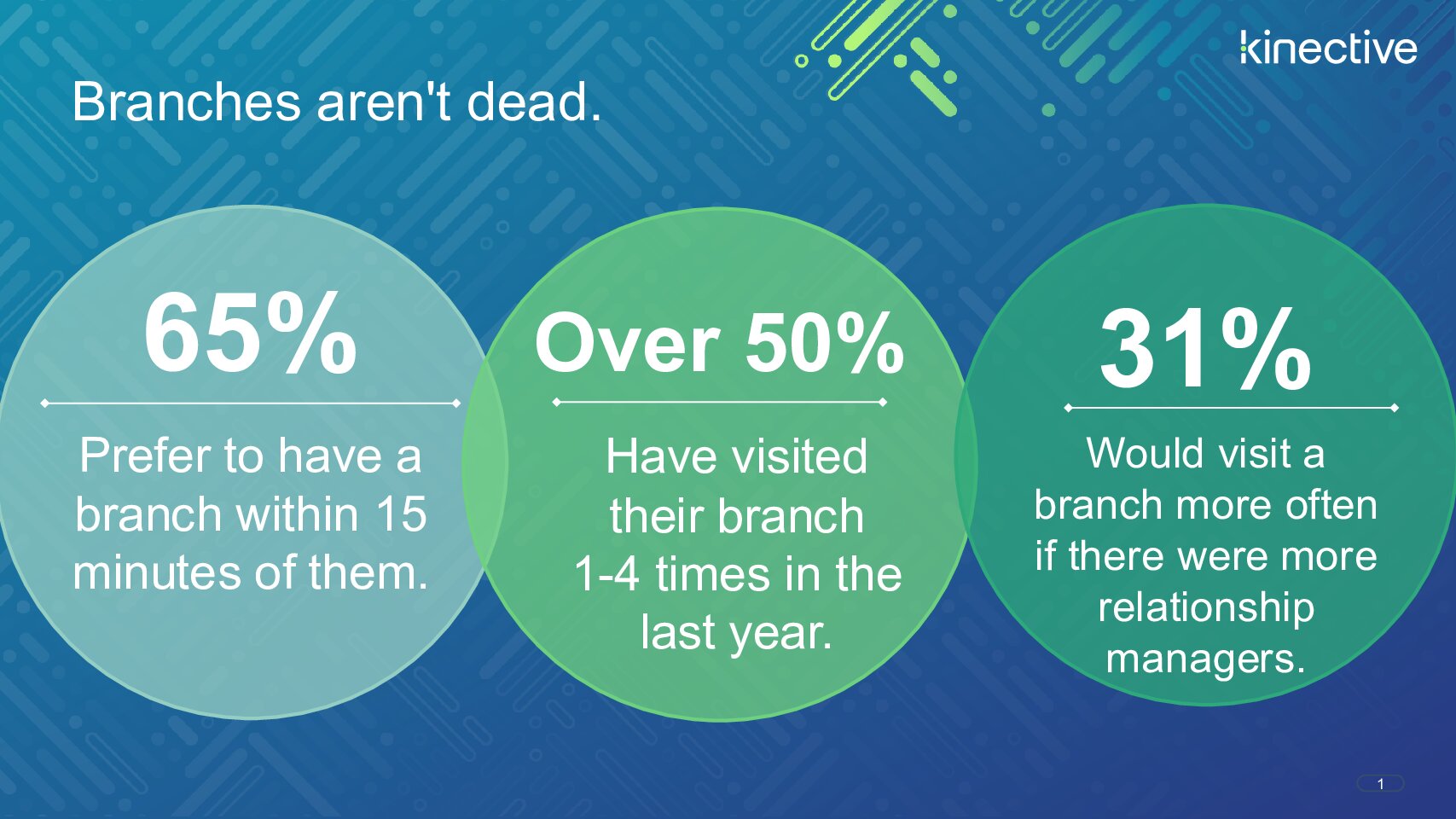

The 65% Truth Nobody Talks About

Let’s start with a statistic that should reshape how you think about branch strategy: 65% of consumers prefer to have a branch location within 15 minutes of them, and over half of consumers have visited their primary bank branch between 1-4 times in the last year.

This isn’t pre-pandemic nostalgia. This is current consumer behavior, and the number hasn’t budged much in decades.

Think about what that means. Even with the convenience of mobile banking, nearly two-thirds of consumers still view the physical branch as a crucial factor in where they bank.

But here’s where it gets uncomfortable: industry research also reveals that when secret shoppers visit branches, 58% of those visits don’t start with a greeting.

No welcome. No acknowledgment. Just a customer or member walking in and trying to figure out where to go.

And when interactions do happen? 66% are product-led rather than needs-based. Meaning the employee is pushing products rather than asking questions and listening.

There’s a massive gap between what consumers want from branch experiences and what they’re actually getting.

And it’s not because branch employees don’t care. It’s because they’re trapped in a system designed around transactions rather than relationships.

The Hidden Culprit: Cash Handling is a Productivity Black Hole

Why do branches struggle to deliver advisory experiences?

Traditional cash handling isn’t just counting money.

It’s counting it multiple times to ensure accuracy. It’s managing drawer limits and making vault runs with dual control—meaning two employees tied up in what should be a simple cash transfer. It’s the anxiety that comes with knowing that a single mistake could mean a write-up, or worse, a conversation about your future at the institution.

This creates a very specific behavior pattern: heads down, eyes on the drawer, minimal engagement with the member standing in front of them. The teller isn’t being unfriendly—they’re being careful. And being careful takes all their attention.

Then there’s end-of-day balancing. In institutions without modern cash automation, this process can take 30 to 45 minutes. On a bad day—when there’s an outage or discrepancy to research—it can stretch to an hour or more.

That’s an hour of employee time, every day, spent verifying that numbers match. Multiply that across branches and employees and you’re looking at thousands of hours annually devoted to a process that adds zero value to members.

The Integration Breakthrough That Changes Everything

At Kinections25, two credit union leaders revealed how they solved this problem and the results were striking.

The key insight: Teller Cash Recyclers (TCRs) have existed for years. But simply having TCRs doesn’t transform branch operations. What transforms branches is how those TCRs are integrated into your systems.

Anna De Leon from CapEd Credit Union explained the difference with striking clarity:

“We went from a non-integrated product to an integrated product and we of course saw the end of day balancing go from multiple minutes like 15, sometimes 20 for the whole staff, to like a couple of minutes as long as there’s no outages or anything.”

Think about that shift. From 15-20 minutes of daily balancing per person to a couple of minutes. Across a branch staff, across all branches, across a full year—that’s a substantial amount of time saved.

But the time savings were just the beginning. Anna continued:

“Even with the outages themselves, we saw a drastic reduction because we’re no longer dealing with a system that’s outside of our core. Every transaction belongs to a member transaction. So even if there is something interesting that happens with the TCR, we can go back and say this transaction belongs to this person.”

Without integration, the TCR is essentially a standalone cash handling device. With integration, every cash movement is tied to a specific member and transaction. The audit trail is complete. Research becomes simple. And the finger-pointing that happens when systems don’t agree? It disappears.

What "Integration" Actually Means

Integrated TCR setup:

- Employees work within their native teller application

- The TCR responds automatically to transactions in progress

- All cash movements are instantly recorded in the core

- General ledger updates happen in real-time for both drawer and TCR

- End-of-day is a quick snapshot verification, not a reconciliation project

- The audit trail is unified and complete

Non-integrated TCR setup:

- Employees log into the core/teller application for transactions

- Employees switch to a completely separate system to operate the TCR

- Cash movements aren’t automatically recorded in the core

- End-of-day requires manual reconciliation between systems

- Discrepancies require hunting through two different audit trails

- When something goes wrong, nobody knows which system to trust

Austin Cain from TruWest Credit Union described their experience with partial integration—and why they’re excited about their upcoming upgrade:

“We’re kind of in the middle ground right now. We’re on a legacy core. We’re in the middle of going through a core conversion… With our current core, we do have integration with TCRs. It does pop up a window within the native application, but that window still acts independently. Tellers could close out of that window and not know it and be out of balance at the end of the day.”

This is an honest look at what “partial integration” means in practice. Yes, there’s a connection between systems. But it’s not seamless enough to prevent errors. There are still opportunities for things to go wrong.

Austin continued:

“The value of having an integration that is just fully capable of recognizing a person, recognizing the transaction that it belongs to and eliminating some of those mistakes not only cuts down on the balancing time, but… the transactional side of things is becoming less maintenance.

You’re having to think less about the cash drawers and less about balancing at the end of the day. And you can spend more time really focusing on serving your members and finding out what their needs are.”

The Real-World Impact

Anna from CapEd shared how this transformation has changed their branch culture:

“It’s becoming more about servicing our members as a whole versus worrying about what’s going on with the cash that’s coming in and out of your TCR. You no longer have a drawer in front of you.”

That last phrase is crucial: “You no longer have a drawer in front of you.”

Psychologically, physically, operationally—the drawer was a barrier between employee and member. It was where attention went. It was where mistakes were made. It was the source of stress and the focus of training.

When the drawer disappears, everything changes.

The Path Forward

The data from CapEd Credit Union tells a clear story: properly integrated cash automation doesn’t just save time—it transforms what’s possible in branch interactions.

When end-of-day balancing drops from 20 minutes to 2, when every transaction is automatically tied to the right member, when outages become rare exceptions rather than regular frustrations, your employees finally have the mental space to focus on what matters.