NXTsoft, the leading provider of data and image migrations to the financial industry, released its quarterly review of industry merger and acquisition data for the fourth quarter of 2019. Derived from data provided by the Federal Reserve System, the research quantifies all U.S. bank M&A activity closing in the fourth quarter of 2019.

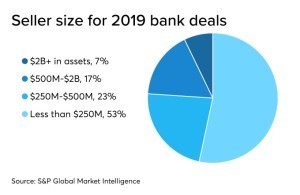

Despite a sluggish start, 2019 ended up being the busiest year for deals since 2016 in terms of the number of mergers. In fact, there were more merger and acquisitions announcements made in the first ten months of 2019 than in all of 2018. A total of 273 M&A’s occurred in 2019, which is a 3% increase over last year’s total number of deals. However, despite the amount of M&A deals climbing the overall deal values, excluding 2019’s largest deal between BB&T and SunTrust, have decreased. Again, excluding the BB&T-SunTrust deal, the deal volume at the end of 2019 was 19% less than that of 2018. Interestingly, the asset sizes of the sellers in 2018 was also statistically lower than previous years with only 10% of sellers having over $1 billion in assets. This is a trend that is anticipated to continue in 2020, and perhaps even grow, due to the existence of fewer and fewer midsize banks, leaving thousands of smaller institutions dealing with the growing pressure and competition from the larger institutions.

Most 2019 deals were very small

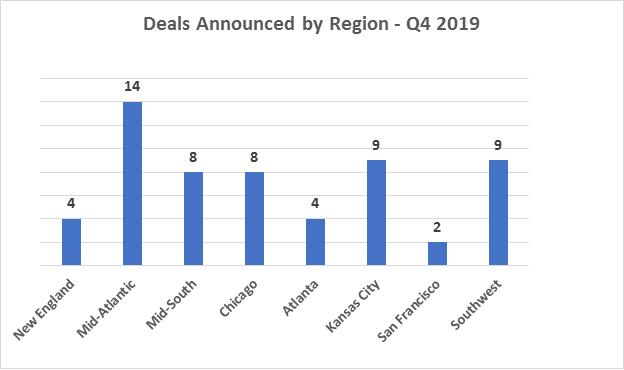

The hotspots around the country for 2019 were the Chicago region (60 total deals) and Kansas City regions. (56 total deals). For the Chicago region this also equated to a 28% increase in total deals over 2018. The Mid-Atlantic region didn’t see the high number of deals like the Chicago region, but they did still see a 41% increase from 2018 with 38 total deals closed. The San Francisco region saw the largest slip from 2018 with a 23% decrease in the amount of deals and only 23 deals closed.

{{cta(’82e891c3-c64e-4b94-9b0e-5bfc25e07abd’)}}

The expectations for M&A market in 2020 are high. “As uncertainty dampens and companies continue to gain strength and liquidity, we do expect them to return to a more aggressive M&A strategy,” states Chris Ventresca the Global Co-head of M&A for JP Morgan Chase. The deals already announced for Q1 of 2020 reflect this strategy already. A total of 58 deals have already been announced for Q1 of 2020 which is an 8% increase from this time last year. In fact in a survey done in late 2019 by Bank Director only 14% of those surveyed say that M&A is an unlikely option for their future, indicating that the increase in deals announced in Q1 is only the beginning of a trend we can see for all of 2020.

Other notable insights from the fourth quarter of 2019 include:

- The Chicago region again had the most deals closed in Q4 with 20 deals closed.

- The New England region had the fewest amount of deals closed in Q4 with only 1 deal closed.

- Q4 of 2019 has had the most deals closed in a quarter since 2016.

- 43% of Q4’s deals came from the Chicago and Kansas City regions.

- The fourth quarter averages almost 73 deals over the past 5 years.

- The most active regions over the past 5 years are the Chicago region and Kansas City region. Those 2 regions account for 42% of all deals closed in the past 5 years.

{{cta(‘a9cae035-6314-4293-8ed8-9209404bd040′,’justifycenter’)}}