The numbers we’re about to share are staggering, and they tell a story that every financial institution leader needs to hear. According to Cornerstone Advisors’ Report, banks could save more than $500,000 annually through better technology efficiency, while credit unions stand to save nearly $1.3 million. The path to these savings? Improving integration and automating workflows.

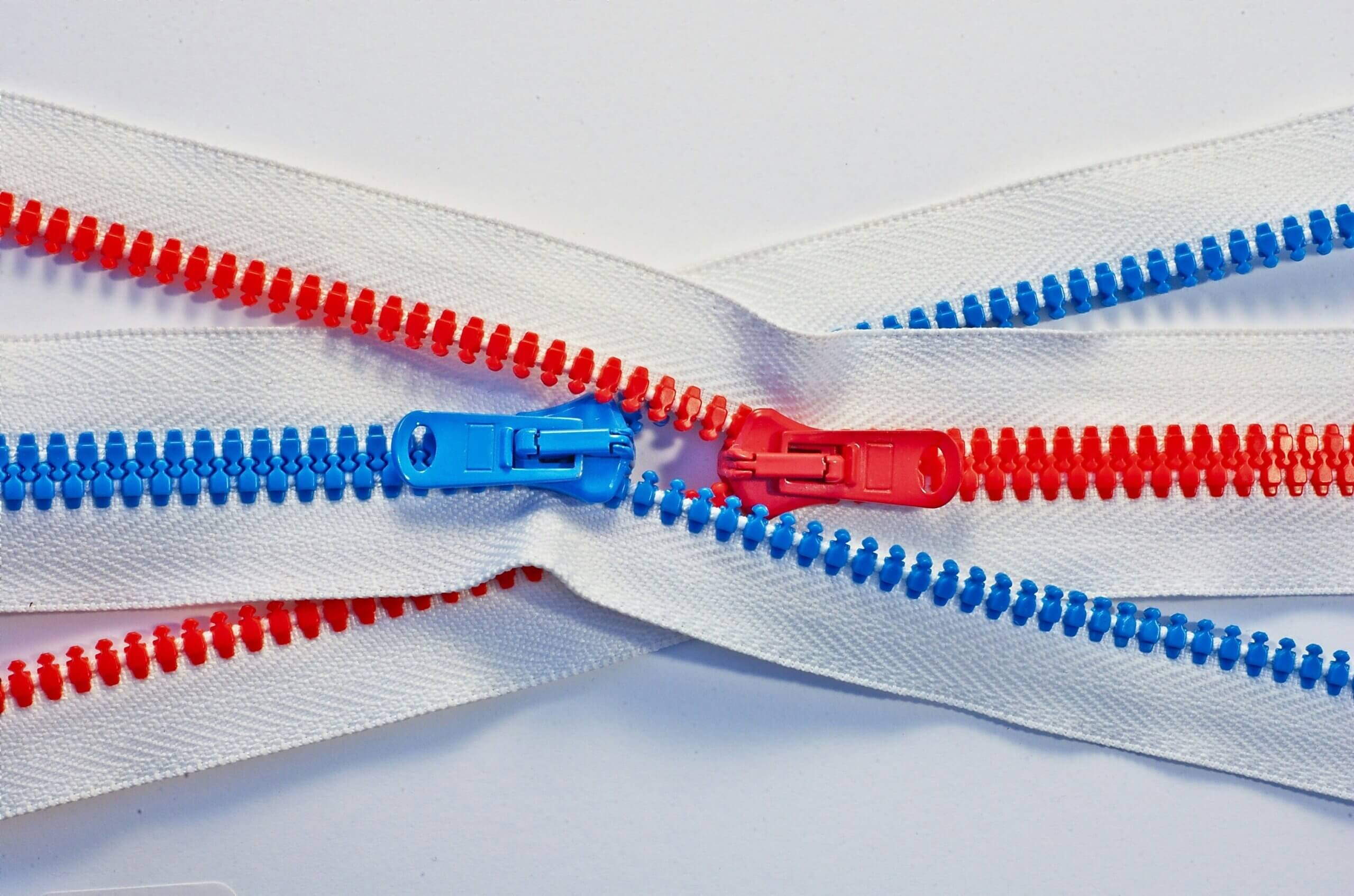

Yet despite these compelling financial incentives, integration challenges continue to plague the industry.

A striking 62% of banks and 53% of credit unions identify lack of integration between systems and applications as their primary obstacle to improving technology efficiency.

The Reality of Fragmented Operations

Many financial institutions today operate more like a collection of independent departments than a connected enterprise.

Consider this common reality: a bank’s ATM monitoring system likely operates in complete isolation from its cash forecasting tools. Branch operations run on one platform while service management lives in a completely separate environment. Document workflows exist in their own bubble, disconnected from the core and other business systems that need access to critical files. The same applies when new fintech solutions don’t integrate with your core and existing systems.

This operational fragmentation is a hidden tax on your institution’s performance. While each individual system may function adequately on its own, the collective result is an expensive, inefficient maze that drains resources and limits potential.

The true cost isn’t just in the technology—it’s in the opportunities lost when systems can’t communicate.

Think about the inefficiencies this creates: multiple software licenses for overlapping functionality and crucial business insights buried in disconnected databases. This often means teams must also spend time on manual data transfers and entering duplicate information into multiple systems, which leaves room for error and data inconsistencies.

As a result, institutions find themselves constantly playing catch-up, responding to issues after they’ve already impacted operations rather than having the integrated intelligence needed to prevent problems before they occur.

The Hidden Costs of Fragmented Systems

When financial institutions operate with disconnected point solutions, they unknowingly trap themselves in what industry experts call “Frankenbanking“—a patchwork of systems that creates more problems than it solves. These fragmented operations don’t just impact the bottom line; they create cascading effects throughout the organization.

Operational Inefficiencies Mount Quickly

Staff spend valuable hours on manual processes, moving data between systems, and managing redundant workflows. What should be seamless operations become time-consuming, error-prone tasks that drain productivity and employee satisfaction.

Customer Experience Suffers

In an era where consumers expect seamless digital experiences, disconnected systems create friction points that can drive customers and members away. When account information doesn’t sync across platforms or transactions require multiple steps across different interfaces, institutions lose competitive ground to more agile competitors.

Innovation Becomes Nearly Impossible

Perhaps most critically, fragmented systems make it nearly impossible for institutions to adapt quickly to market changes or adopt new fintech solutions. Without proper integration capabilities, each new technology becomes another isolated island in an already complex ecosystem.

What’s Possible with Strategic Integration

The institutions that are getting integration right are seeing transformational results across multiple dimensions:

Dramatic Cost Savings

Beyond the direct savings identified by Cornerstone Advisors, financial institutions report reduced maintenance costs, fewer redundant licenses, and decreased need for manual interventions. When systems work together seamlessly, operational overhead plummets.

Enhanced Operational Efficiency

Automated workflows and real-time data synchronization eliminate bottlenecks and reduce processing times. Staff can focus on high-value activities instead of managing system interfaces and re-entering the same account information in multiple fields.

Greater Flexibility and Innovation

With proper integration architecture, institutions gain the freedom to choose best-of-breed solutions without worrying about connectivity challenges. This flexibility enables rapid adoption of new technologies and services as market demands evolve. Translation: FIs can get new solutions live faster and see the ROI from their investments earlier.

Data-Driven Decision Making

Unified systems create comprehensive data intelligence that reveals operational patterns, customer behaviors, and growth opportunities that remain hidden in siloed environments.

Plan Your Integration Path

Successfully navigating the future of banking and the integration needs that come with it requires a strong vision and the right partnerships.

A Clear Vision

Start with understanding your institution’s unique operational needs and customer or member experience goals. Integration should solve specific business problems, not just connect technology for technology’s sake.

The Right Partner

Perhaps most importantly, successful integration requires partnering with those who understand banking operations intimately. Your partner should offer purpose-built solutions designed specifically for financial institutions, with banking-specific workflows, compliance considerations, and integrations built in from the start. The right partner provides solutions to your specific challenges, not just tools or templates that get you only partway there.

Connected Operations to Help You Compete & Win

The institutions that will thrive in the coming years are those that view integration not as a technical necessity, but as a strategic advantage. By serving as the connective tissue between core banking systems, branch technologies, document workflows, and third-party innovations, a partner like Kinective can create a cohesive foundation that enables FIs to work more efficiently, unlock innovation and deliver better banking experiences.

The question isn’t whether your institution can afford to invest in deeper integration—it’s whether you can afford not to.

With millions in potential savings and significant competitive advantages at stake, the time for greater system connectivity is now. Ready to get started?