Say hello to Connectivity as a Service! NXTsoft’s OmniConnect platform allows fintech vendors to quickly connect to any financial institution’s data through our documented standard APIs. OmniConnect provides secure APIs for the digital infrastructure needed to build and scale any fintech application. That includes the functionality to authenticate, onboard clients and accounts, and retrieve customer and account information from a Financial Institution’s core or auxiliary system. All OmniConnect APIs are built on REST principles with resource-oriented URLs hosted in AWS returning in JSON format. So, how does it work?

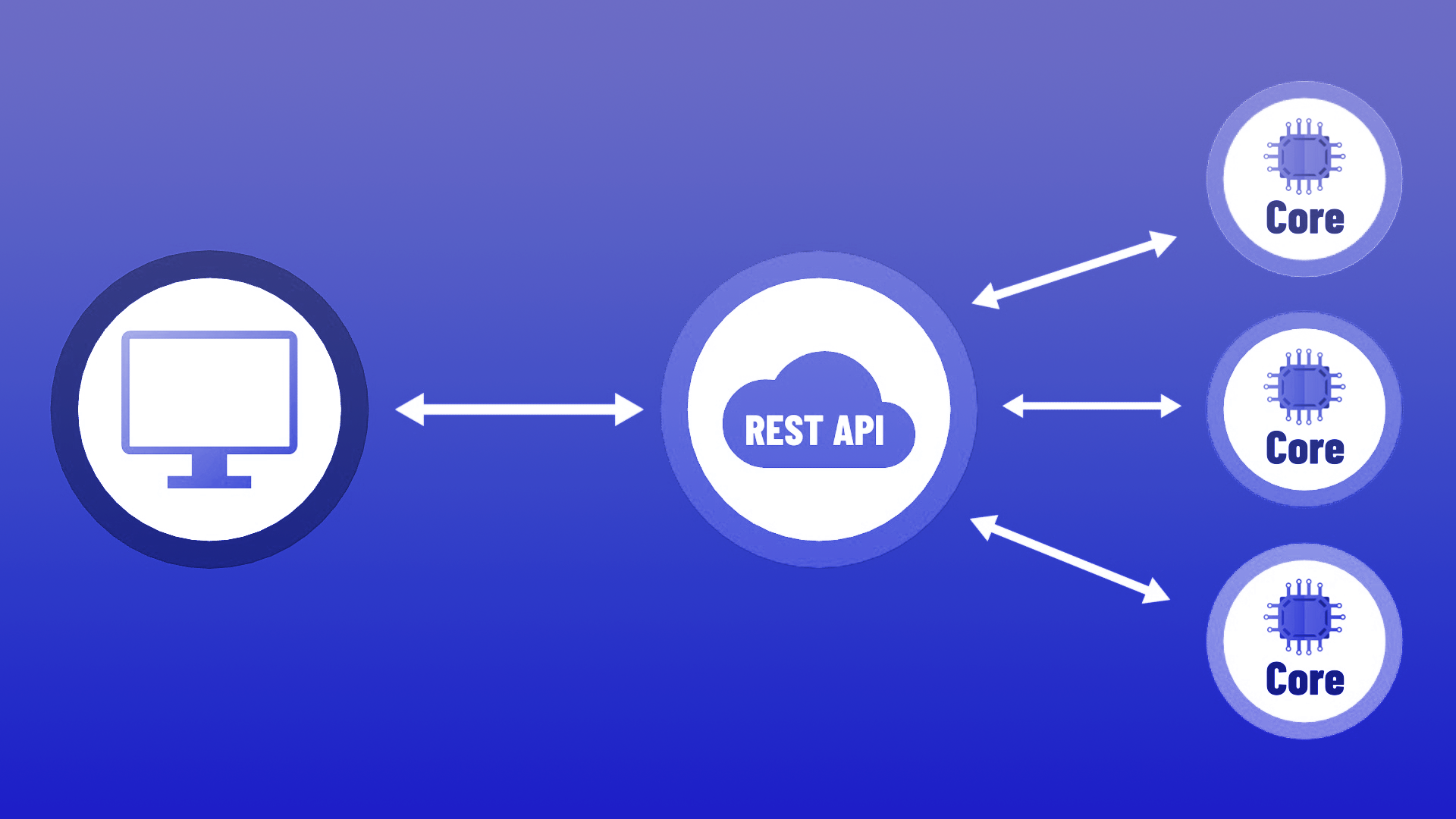

Any data that you’re looking to retrieve is returned in a standardized format, allowing your development staff to write to a single API and receive back a single response. We take the request and deliver it to the various cores we support, often orchestrating multiple events to return a single response to you. Our API is core-agnostic, handling all transactions required to perform the action you need. When you’re dealing with a single REST API, it’s so much easier to develop and communicate with a multitude of cores.

NXTsoft’s API platform goes beyond the core data. Connect your fintech application to other systems such as CRM or marketing platforms. Our Connectivity as a Service platform makes it easy for you to get the data you need, wherever it is.

Great connectivity shouldn’t compromise security. For authentication, OmniConnect uses OAuth 2.0. We use an ID and a JWT token generated from OAuth 2.0 to validate that the partner and client have access to the specific data & systems to which they want to interact. Our infrastructure is hosted in a secure AWS environment behind a firewall and utilizing an API gateway for additional security.

Connect with NXTsoft today to discuss how the right API strategy can save you time and money.