Many financial institutions are exploring new sales channels because of misinformation about the future of branch banking. While it is excellent that banks & credit unions are innovating, modernizing, and diversifying their business model, the branch channel is still a viable & valuable revenue generator for the near future. However, branches must be adjusted to become more efficient.

Branch banking is still the best sales tool

Banks and credit unions reported that, on average, 84% of pre-lockdown branch network traffic recovered the following year. The transition to digital banking hasn’t been the smoothest for many FIs and has contributed to this return of traffic to branch locations. We’ll touch more on that later. But that isn’t the only reason for the return of traffic.

Many clients still enjoy the value that branches bring to their banking experience, especially for personalized advisory services. FIs also reported that 62% of sales are attributed to the branch channel, with another 27% and 11% from digital and contact centers, respectively.

So, no—the branch is not dead! Then, why are FIs changing their branch channel strategy?

The desired functions for branches are changing. Consumers continue shifting to using self-service & digital banking channels to handle transactions. With decreased traffic within the branch, offering personalized advisory services is proving the best way to capitalize on the branch channel’s revenue potential while dialing in on digital offerings.

Digital is not meeting expectations… yet

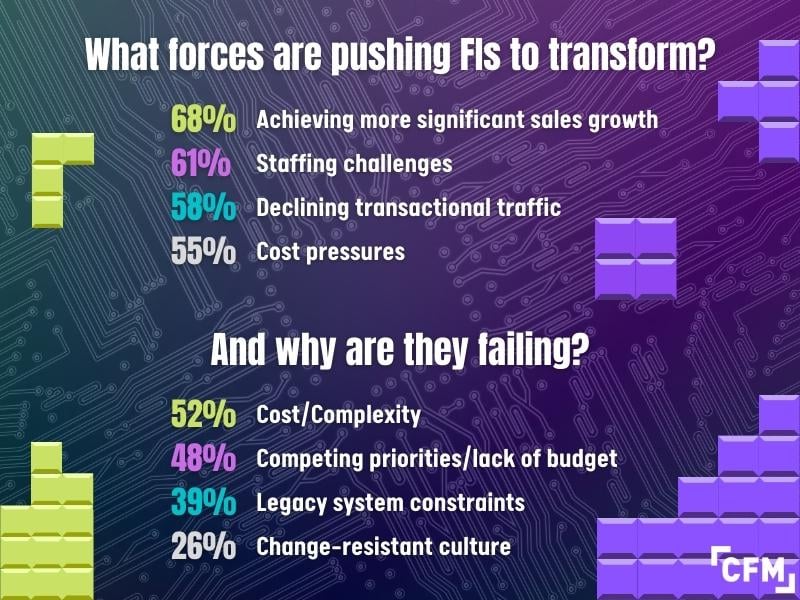

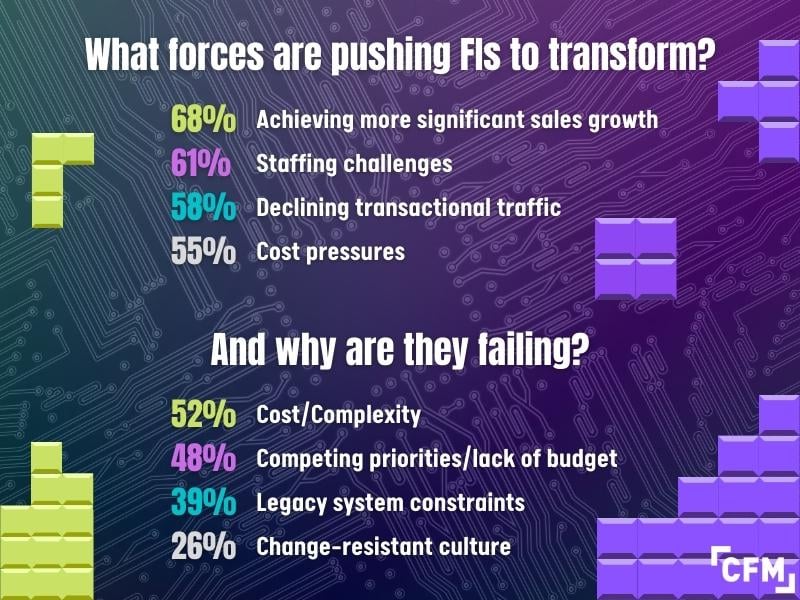

Most financial institutions inaccurately forecasted significant growth in digital sales from 28% to 35% between 2020 and 2021. Instead, digital sales attribution ended up decreasing to 27%. But how were the industry predictions so far off? Well, the digital banking process is still being perfected and developed, and consumers don’t love the way it works at the moment. But here are some more specific details:

• Outdated IDV (identity verification) approaches

• Lack of real-time funding support – delay & friction of trial deposits a common CX killer

• Poor follow-up rates on abandoned applications

• No comprehensive, systematic digital onboarding program

• Consumers are typically just utilizing digital channels for transactional purposes

Download the infographic too!

It’s well understood that the demand for convenience and digital access is increasingly important to clients. How can you make your digital sales channel work? First, maximize the effectiveness of your digital customer acquisition processes. Second, automate in the branch where and when the budget allows.

Branch banking & digital banking are both crucial pieces of modern banking

Universal Associates – 59% of FIs are already implementing this staffing change. Now, that doesn’t mean that it looks the same or even works as efficiently & effectively as it should. Universal associates must be cross-trained adequately and appropriately equipped with core-integrated portable pin pads or tablets to best implement this service model. Versatile staff using devices with agile & powerful software boosts customer satisfaction, cuts operating costs, and allows more revenue-building conversations with clients.

Alternative tasking – 50% of banks and credit unions are tasking their staff with making outbound calls or offering remote support. This has been a previously underutilized revenue-sourcing task that more FIs are beginning to implement in branches.

Self- and assisted-service options – including mobile banking, ATMs, and ITMs popular among most clients and are a wise investment. However, this must be weighed up carefully as any self-service option utilizing remote assistance doesn’t generally provide clients with an adequately satisfactory experience. If clients are going to a branch, even to use a self-service kiosk, any assistance necessary during the process would be a dish best served in person. Pairing CFM’s GENIX, an integrated self-service kiosk software, and the tablet-based NOMADIX to assist with in-person transactions gives clients their ideal experience.

Technology & integrations – 40%+ of FIs are likely to use tablets & equip staff with tools to assist clients virtually, and integration is the way to cost-effective success now. If you want to cut down on end-of-day balancing costs, maximize transaction accuracy & efficiency, and transition to modern banking without a full-blown infrastructure overhaul, CFM is your best bet.

Need to put the pieces to modern banking in place?

480.783.5864 | www.whycfm.com

Sources: CELENT Report THE POST-PANDEMIC BRANCH NETWORK, 2022