As I discuss the upcoming CECL implementation and transition with banks and credit unions I’ve noticed a common theme. Many institutions think CECL is something to defer for another year or so… Even to 2022. Out of sight, out of mind.

In reality, nothing could be further from the truth.

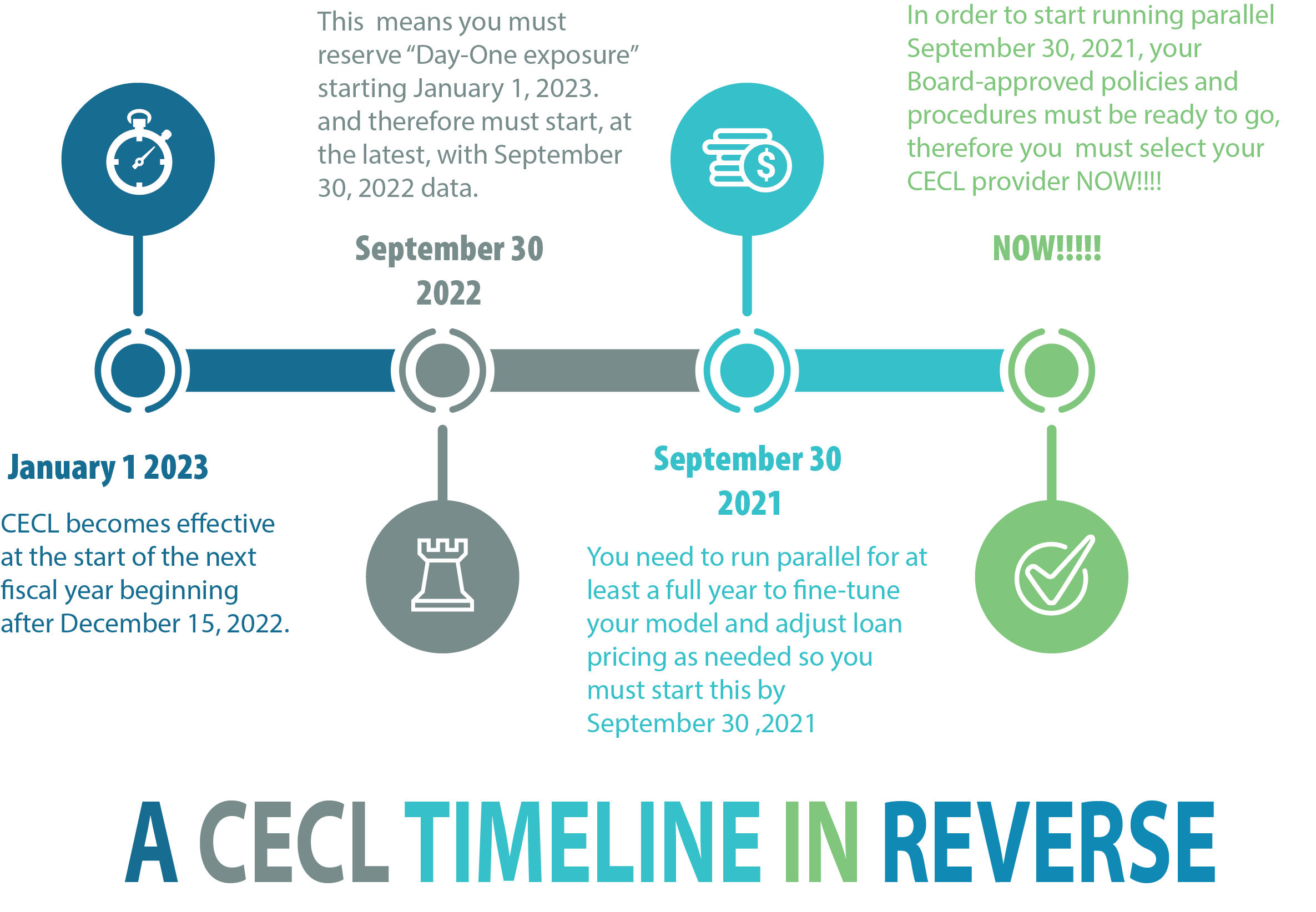

Let’s take a detailed look at steps to be taken and the timeline, starting with the furthest possible implementation date. Use this roadmap to guide your own CECL implementation plan.

If you’re a smaller private institution, and the 2023 date applies to you, here’s your practical timeline, including the steps you need to take in the interim.

1) CECL becomes effective at the start of the next fiscal year beginning after December 15, 2022.

For most financial institutions, that’s likely to be January 1, 2023. And that’s where the often-mentioned 2023 timeframe arises. But look again carefully. CECL starts January 1, 2023. What does that mean?

2) Applying CECL starting January 1, 2023 means that you must reserve “Day-One exposure” starting January 1, 2023.

CECL requires you to reserve the expected lifetime loss on your new loans on the origination date of that loan. So how are you going to make new loans in January 2023 without a calculated and documented CECL reserve estimate? The short (but painful) answer is that you aren’t. This leads us to our next point…

3) To have an operational CECL reserve calculation as of January 1, 2023 you can’t wait for December 31, 2022 data.

You know how busy and hectic year end is. Call reports and 5300s aren’t even due until late January. And even if you had the data, you’d need time to process and document it. So there’s no way you can wait for December 31, 2022 year end data. The truth of the matter is that to be operational with CECL on January 1, 2023 you must start, at the latest, with September 30, 2022 data.

4) To safely make the change from the incurred method to the expected loss method (CECL) you should run parallel for at least a full year.

CECL is indisputably the biggest accounting change to hit financial institutions in decades. It’s a generational shift and a complete transformation from today’s incurred (current loss) method to tomorrow’s CECL (current risk) method.

If nothing else changed, just the shift to lifetime loss reserves (and the expected increases in reserves from going to a multi-year perspective) plus the resultant impact on your capital levels alone should be enough to demand a thorough review before going “live”. But there’s much more to be done.

You need the time running parallel to finetune your model, adjust loan pricing as needed (Do you understand how CECL is likely to influence your loan pricing?), and to familiarize everyone in the institution (as well as your various State and Federal examiners) with all of your changes. So realistically, you need to start CECL by 9/30/21 to safely and practically meet that Jan 1, 2023 start date.

5) In order to start running parallel September 30, 2021, your Board-approved policies and procedures must be ready to go leading up to that date.

There will still be tweaks to your policies and procedures while running parallel, and for the foreseeable future. But to have the bulk of the Board’s drafting, reviewing, and approving of CECL policies complete by 9/30/21 you’re missing one big piece of the puzzle.

You can’t do this if you haven’t determined exactly how you are going to implement CECL. This means your CECL solution selection must happen NOW.

Every bank and credit union needs to start now with internal education, quantifying and estimating your likely CECL financial impact, and understanding the demands on your institution’s resources, time and expertise. Few financial institutions have excess time and resources, and almost none have the required expertise inhouse. NXTsoft can help you connect the dots, and avoid the pitfalls, in prepping for CECL.

6) Don’t let the cost and complexity of CECL paralyze you.

We understand your limited time and resources. We also understand that you don’t want to spend your hard-earned money before you need to. We have a plan to help you start filling in your CECL gaps. Best of all you can get an “Analyst with Every Report” to walk you, your top management team, and your Board of Directors through these massive changes at no additional cost.

What’s The Bottom Line?

It’s now time for every bank and credit union to get started seriously working through the CECL timeline. Your examiners will be looking for your progress this year. We can help those uncomfortable questions get answered a little bit more easily. And we can help you navigate the twists and turns on your CECL roadmap. Just let us know you’re interested and we’ll do all the heavy lifting.

Get your free CECL report with your call report data!