Unlock Innovation.

Deliver Better Banking.

Reimagine what’s possible for your financial institution. As the industry’s most trusted technology partner, we empower banks and credit unions to deliver exceptional experiences while maximizing operational efficiency.

Transform your ability to serve and delight consumers in every interaction and turn today’s market challenges into tomorrow’s competitive advantages.

November 6, 2025

We’ve reimagined Kinections25 to be a virtual experience in order to bring the latest in banking innovation directly to you.

Join us November 6th for incredible speakers, meaningful product insights, and thought leadership that can take your financial institution to the next level – all from the convenience of your home or office.

Empower Your Journey to Transformation with:

💡 EDUCATIONAL SESSIONS

6 interactive breakout sessions and keynotes covering topics from company vision and product strategy to deep-dive solution focused breakouts.

🔮 STRATEGIC INSIGHTS

Hear directly from Kinective’s leadership about our evolving company mission and commitment to simplifying technology access for financial institutions.

🎯 ACTIONABLE SOLUTIONS

Leave with practical strategies—whether you’re tackling digital transformation, data-powered strategies or working to stay competitive and relevant in your markets.

Over 4,000 banks, credit unions, and fintechs trust us.

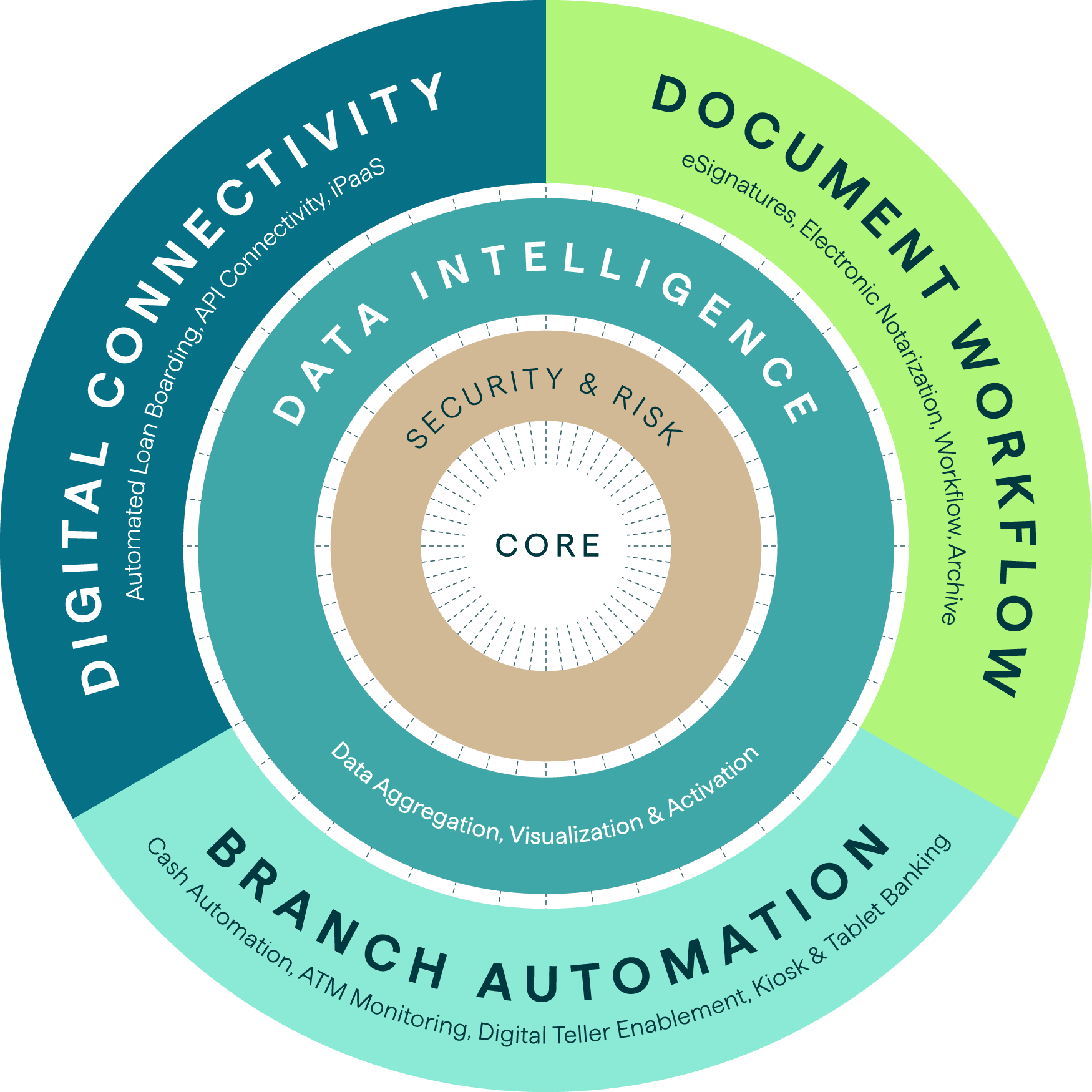

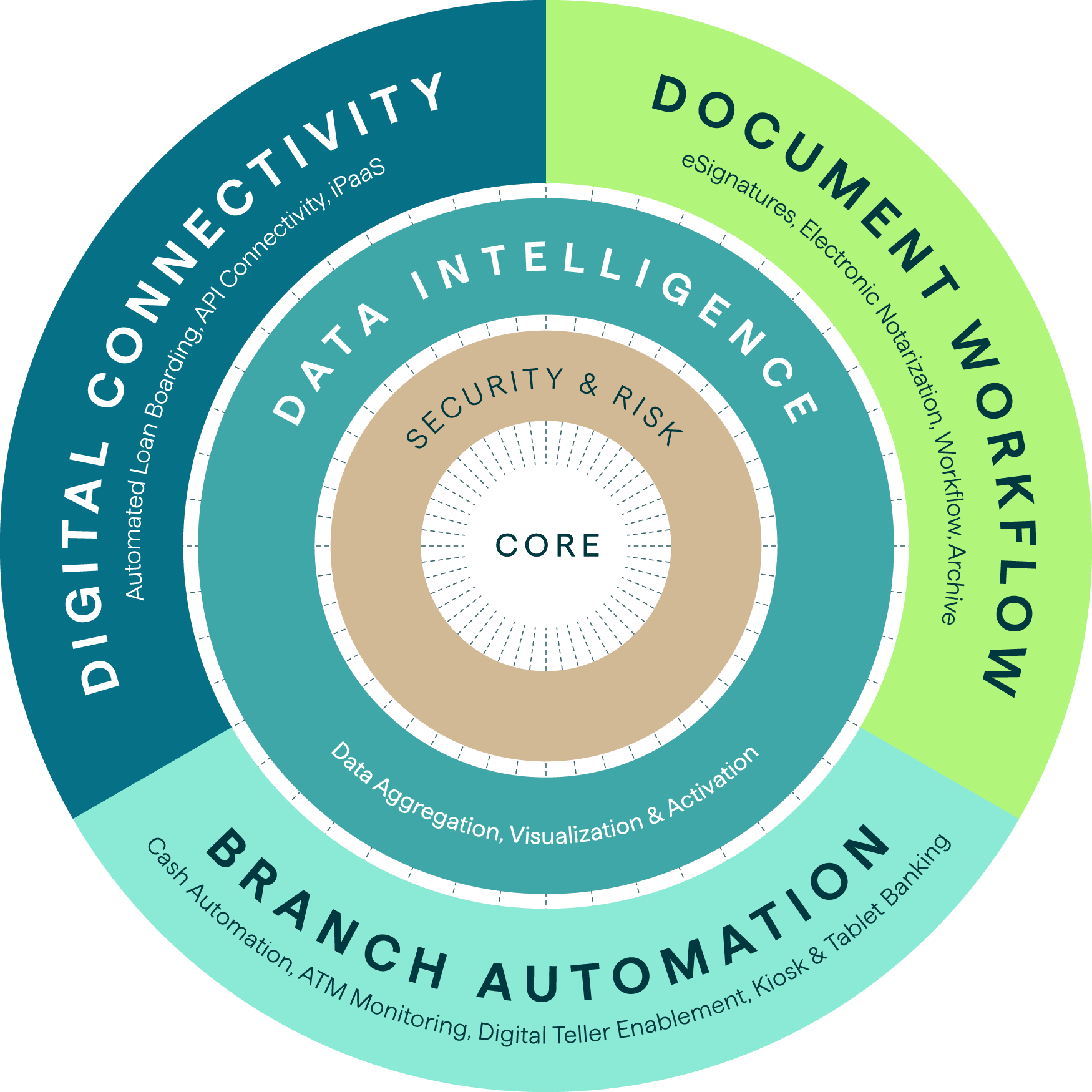

The Kinective Banking Ops Platform

Reimagine your operations, services and customer engagement with the Kinective Banking Operations Platform – powered by data intelligence. Kinective’s uniquely integrated suite provides you with the freedom to choose how you can activate data intelligence, streamline operational processes and deliver better banking experiences.

The Kinective Banking Ops Platform

Reimagine your operations, services and customer engagement with the Kinective Banking Operations Platform – powered by data intelligence. Kinective’s uniquely integrated suite provides you with the freedom to choose how you can activate data intelligence, streamline operational processes and deliver better banking experiences.

The respected brand for banking innovation.

Over the past 26 years, our Banking Operations Platform has revolutionized banking services and consumer experiences for thousands of financial institutions.

4,000+

BANKS & CREDIT UNIONS

Efficiency from automation combined with superior integration.

Boost speed and accuracy through process automation and dynamic workflows that seamlessly integrate across all banking core and fintech applications.

40+

CORE INTEGRATIONS

Smarter banking solutions made simple.

Banks

Transform your institution with our Banking Operations Platform—streamline business processes, unlock rich data insights, and deliver exceptional customer experiences.

Credit Unions

Empower your credit union with our integrated platform that enhances member experiences, creates new efficiencies while turning your institutional data into strategic advantage.

Fintechs

Launch your breakthrough application to banks and credit unions faster and more efficiently with our pre-built core integrations.

BRANCH AUTOMATION

Say hello to modern branch experiences.

Unlock the potential of streamlined workflows, increased efficiency, and elevated consumer experiences with our advanced cash automation, digital teller enablement, tablet banking, and self-serve kiosks. Seamlessly integrated with your core systems and branch hardware, these dynamic solutions are designed to transform your in-branch operations and create memorable, customer-centric experiences that set your institution apart.

DOCUMENT WORKFLOW

Smooth moves through digital document transactions.

Revolutionize your internal processes and streamline document workflows across your institution with a banking-inspired, eSignature experience that automates document execution and routing, with seamless archiving into your ECM/Imaging repository. Experience end-to-end digital processing that delivers the seamless banking experiences your consumers expect, while driving operational efficiency and boosting compliance.

DIGITAL CONNECTIVITY

Power up innovation.

Transformation sounds great, but legacy banking systems can make it hard to achieve. Our Digital Connectivity technology is the soluton. These ground-breaking technologies bridge the gap between legacy systems and modern services, empowering you with limitless Fintech integrations with your core. Gain the flexibility and control to deliver new services faster, reduce operational complexity, and unlock the innovation needed to stay ahead in a competitive market.

DATA INTELLIGENCE

See your customers and operations through an entirely new lens.

You invest millions in technology, people, and services annually—yet have limited visibility into how these investments perform or impact customer relationships. What if you could see beyond siloed systems to understand not just who your customers are, but their complete relationship with your institution? What if you could identify growth opportunities hidden within your operational data? Transform raw data into actionable intelligence that reveals opportunities previously invisible to you.

SECURITY & RISK

Mitigate risk with advanced asset and liability management.

Financial data doesn’t have to be complicated or overwhelming. Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion solutions.