WELCOME TO KINECTIVE

Connect to the future of banking.

Kinective is the force multiplier for accelerating transformation through our unique Banking Operations Platform. By simplifying access to innovation, we help financial institutions break down barriers, unlock new products and services, and enhance their competitive edge.

Over 3,000 banks, credit unions, and fintechs trust us.

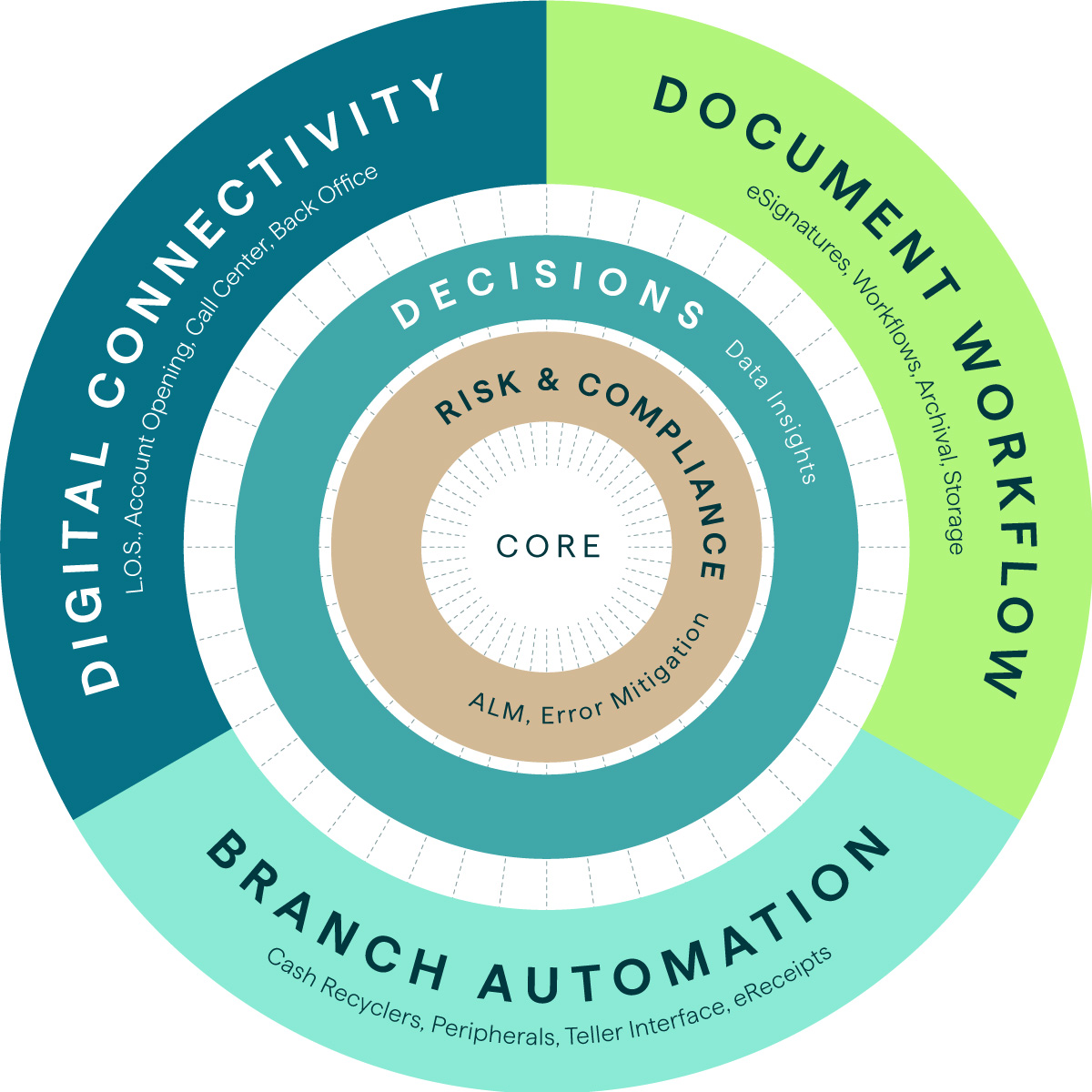

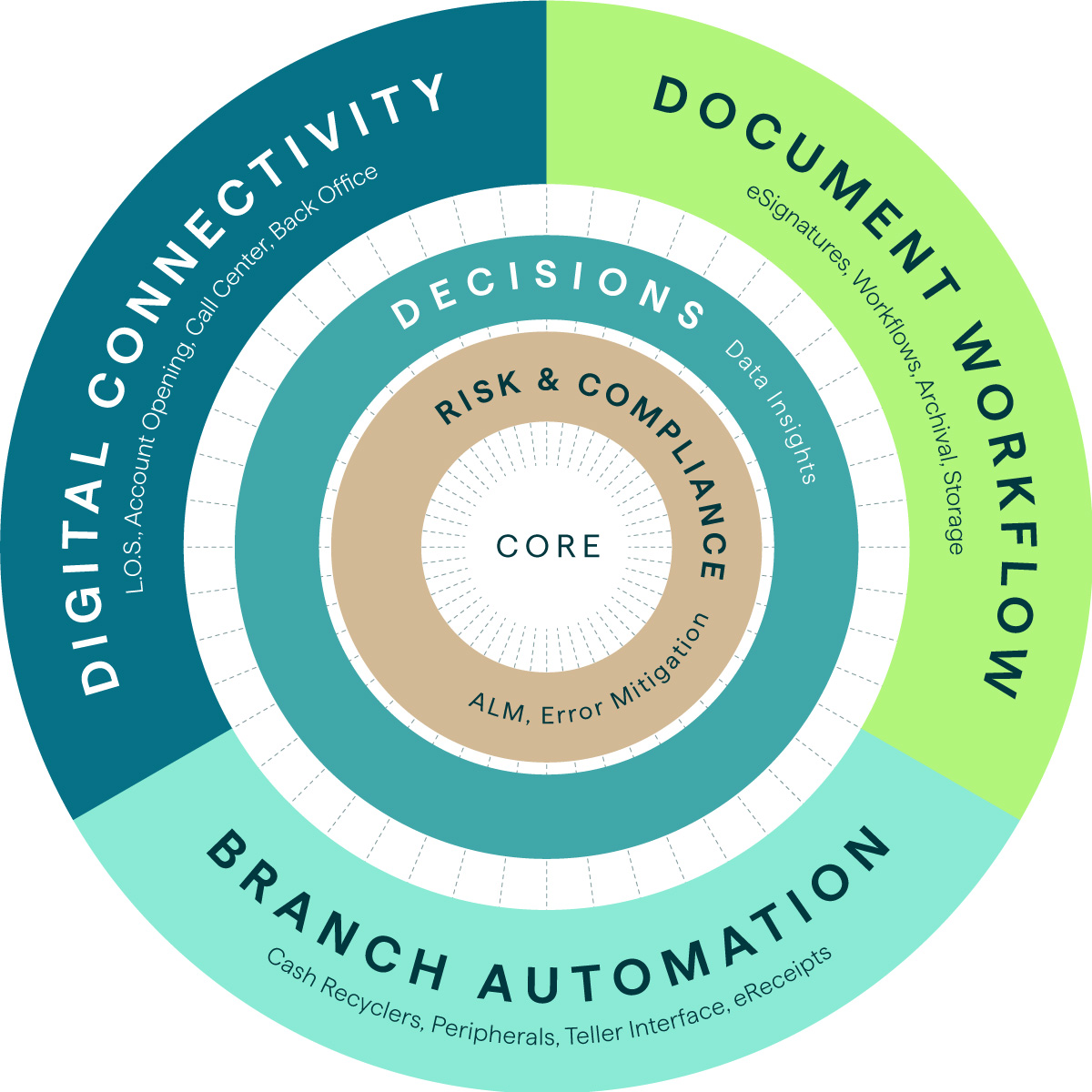

The Kinective Banking Ops Platform

Reimagine your banking operations with the Kinective Banking Ops Platform. Kinective’s unique solutions suite provides your institution with the freedom to choose how you want to transform your banking services, where you want, and most importantly… when you want.

The Kinective Banking Ops Platform

Reimagine your banking operations with the Kinective Banking Ops Platform. Kinective’s unique solutions suite provides your institution with the freedom to choose how you want to transform your banking services, where you want, and most importantly… when you want.

The future of banking, made just for you.

Banks

Harness the power of API connectivity and workflow automation to transform banking operations.

Credit Unions

Connect your core to best-of-breed fintech solutions and deliver differentiated member experiences.

Fintechs

Introduce your innovative technology solution to the entire banking sector through our pre-built core integrations.

BRANCH AUTOMATION

Say hello to modern branch experiences.

Unlock the potential of streamlined workflows, increased efficiency, and elevated consumer experiences with our advanced cash automation, digital teller enablement, tablet banking, and self-serve kiosks. Seamlessly integrated with your core systems and branch hardware, these dynamic solutions are designed to transform your in-branch operations and create memorable, customer-centric experiences that set your institution apart.

DOCUMENT WORKFLOW

Smooth moves through digital document transactions.

Revolutionize your internal processes and streamline document workflows across your institution with a banking-inspired, eSignature experience that automates document execution and routing, with seamless archiving into your ECM/Imaging repository. Experience end-to-end digital processing that delivers the seamless banking experiences your consumers expect, while driving operational efficiency and boosting compliance.

DIGITAL CONNECTIVITY

Power up innovation.

Transformation sounds great, but legacy banking systems can make it hard to achieve. Our Digital Connectivity technology is the soluton. These ground-breaking technologies bridge the gap between legacy systems and modern services, empowering you with limitless Fintech integrations with your core. Gain the flexibility and control to deliver new services faster, reduce operational complexity, and unlock the innovation needed to stay ahead in a competitive market.

RISK & COMPLIANCE

Mitigate risk with advanced asset and liability management.

Financial data doesn’t have to be complicated or overwhelming. Measure and manage risk while maximizing profit with our enterprise-level interest rate risk management, reporting, and data conversion solutions.

DECISIONS

Remove the guesswork with operational data visibility.

You invest millions of dollars in technology, people, and services each year, but do you know how those investments are performing? Gain visibility into cash management performance and cash recycler device health with our decisioning and insights solution. Gain maximum return on your technology investments.

The Ultimate Guide to the Future of Banking.

Whether you’re on a mission to gain deposits, attract rockstar talent, or reduce unnecessary costs—determining the right technologies can feel daunting. Here’s how to break down barriers, unlock new services, and enhance your competitive edge.

Access the largest library of integrated fintech solutions.

Easily connect banking cores with best-of-breed fintech solutions to deliver new services, modernize operations, and increase client delight.

80+

BRANCH AUTOMATION

Flexibility to choose any system, technology, or provider.

Immediately access innovation via comprehensive fintech and core integrations, empowering purchasing choice and a composable banking strategy.

100%

FOCUSED ON FINANCIAL INSTITUTIONS

Speed into your transformation journey.

Turnkey connectivity allows you to innovate at your pace and scale growth without the need for extensive development resources.

3,000+

CUSTOMERS

Efficiency driven by automated processes via integrated systems.

Boost profitability by eliminating manual processes and ensuring accurate, faster, and more efficient workflows.

40+

INTEGRATIONS WITH CORES USED BY 99% OF U.S. FINANCIAL INSTITUTIONS

Access the largest library of integrated fintech solutions.

Easily connect banking cores with best-of-breed fintech solutions to deliver new services, modernize operations, and increase client delight.

80+

BRANCH AUTOMATION

Flexibility to choose any system, technology, or provider.

Immediately access innovation via comprehensive fintech and core integrations, empowering purchasing choice and a composable banking strategy.

100%

FOCUSED ON FINANCIAL INSTITUTIONS

Turn-key solutions for secure, comprehensive, and supported connectivity.

One connection to avoid any DIY disasters with full service across the entire process—from development to support.

100%

FULLY SUPPORTED CONNECTIVITY

Connect to your future.

What do you want to transform?

Digital Connectivity

Branch Automation

Document Workflow

Decisions

Risk & Compliance

Over 3,000 banks, credit unions, and fintechs trust us.

Case Studies

Real stories with real impact.

Integrations

The largest library of integrated fintech solutions.

Press

Kinective in the news.

Our Values

We walk our talk.

Typical company mottos are often plastered on walls alongside picturesque scenes of eagles and kittens, but over time they become cliché and lack true substance.

At Kinective, we’re different. We don’t just throw around empty words. We strive to be the company FI’s want to partner and work with and embody the values we say. Our deep understanding of the banking industry drives us to align our actions with market needs, creating genuine impact and value for our customers.

At the core of Kinective, authenticity reigns. No fluff or empty promises here. We’re committed to delivering meaningful change in banking. Join us on our journey to transform the industry, one innovative step at a time.

Deliver success.

We strive to exceed customer expectations.

We are powered by a relentless commitment to delivering quality and service to our customers. We turn everyday interactions into positive, memorable experiences that create long-lasting Kinective ambassadors.

One Kinective.

Together, we win.

By embracing a “better together” mindset, we unleash the full potential of our team and propel Kinective from good to great.

Grit with grace.

We face problems head on, respecting others along the way.

We aren’t afraid to step outside of our comfort zone to accomplish the common goal. We believe that progress thrives on constructive dialogue and a commitment to understanding.

Build the future.

We are driven by the pursuit of what’s possible.

Building the future requires embracing change and challenging the status quo. We believe that the best idea wins, embodying a culture of innovation.

Welcome to the future of banking.

Banking today doesn’t deliver on modern expectations. Executives know they need to transform, but getting there is complex and filled with roadblocks.

Until now.

Kinective exists to solve banking’s biggest challenges by providing the most open and connected platform to scale faster and allow banks and credit unions to focus on what really matters – providing the best client experience. Kinective’s best-of-suite solutions support FIs in their efforts to transform the way they work and radically improve the client experience.

Our mission is simple: to deliver access to innovation in banking. Through connectivity with best-of-breed fintech solutions, we break down barriers, accelerate progress, and unlock new possibilities.

Welcome to the future of banking.

Banking today doesn’t deliver on modern expectations. Executives know they need to transform, but getting there is complex and filled with roadblocks.

Until now.

Kinective exists to solve banking’s biggest challenges by providing the most open and connected platform to scale faster and allow banks and credit unions to focus on what really matters – providing the best client experience. Kinective’s best-of-suite solutions support FIs in their efforts to transform the way they work and radically improve the client experience.

Our mission is simple: to deliver access to innovation in banking. Through connectivity with best-of-breed fintech solutions, we break down barriers, accelerate progress, and unlock new possibilities.

We saved you a seat.

Want to be a part of our mission to shape the future of banking? Check out our job openings!

Our Values

We celebrate our differences and are united by our core values.

Deliver success.

We strive to exceed customer expectations.

We are powered by a relentless commitment to delivering quality and service to our customers. We turn everyday interactions into positive, memorable experiences that create long-lasting Kinective ambassadors.

Grit with grace.

We face problems head on, respecting others along the way.

We aren’t afraid to step outside of our comfort zone to accomplish the common goal. We believe that progress thrives on constructive dialogue and a commitment to understanding.

One Kinective.

Together, we win.

By embracing a “better together” mindset, we unleash the full potential of our team and propel Kinective from good to great.

Build the future.

We are driven by the pursuit of what’s possible.

Building the future requires embracing change and challenging the status quo. We believe that the best idea wins, embodying a culture of innovation.