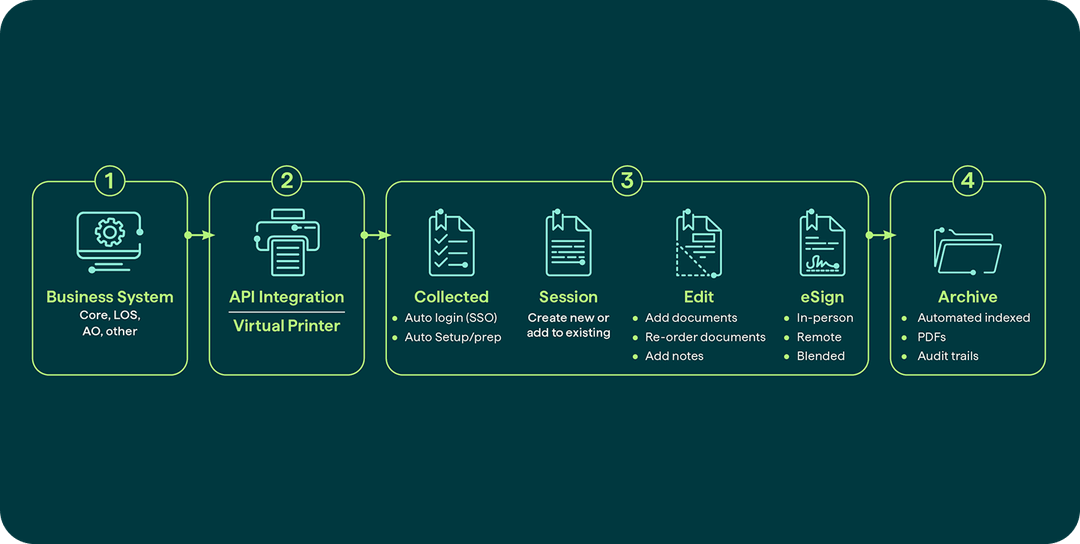

Document Workflow

Transform Every Transaction with Connected, Seamless eSignatures

Get documents signed faster and easier than ever before! Significantly transform the way documents flow across your institution with the only enterprise eSignature platform made exclusively for financial institutions.

KINECTIVE SIGNPLUS™

The most comprehensive eSignature experience in banking.

When it comes to banking expertise, outstanding customer service, and pricing that makes sense for financial institutions—others just don’t compare. Kinective SignPlus™ (formerly IMM eSign Plus) is an easy-to-use solution chosen by thousands of financial institutions to eliminate paper-based signing processes and power millions of “end-to-end” electronic transactions every month. Banking-based document workflows emphasize connecting the client experience to the subsequent back-office processes to deliver a comprehensive end-to-end solution.

• All of your favorite features of Sign

• Banking-tailored processes, workflows, document archiving, and support

• Out-of-the-box and custom rules-based workflows automate tasks to team members in a logical flow

• Standardize, automate, and control critical operational processes

• Automated routing with alerts and email notifications to keep the process moving efficiently across your organization

• Automated archival and enhanced audit trail ensure compliance

• Real-time business intelligence dashboard provides actionable insights into signing activity, channel performance, and operational trends to optimize workflows

KINECTIVE SIGNPLUS™

The most comprehensive eSignature experience in banking.

When it comes to banking expertise, outstanding customer service, and pricing that makes sense for financial institutions—others just don’t compare. Kinective SignPlus™ (formerly IMM eSign Plus) is an easy-to-use solution chosen by thousands of financial institutions to eliminate paper-based signing processes and power millions of “end-to-end” electronic transactions every month. Banking-based document workflows emphasize connecting the client experience to the subsequent back-office processes to deliver a comprehensive end-to-end solution.

• All of your favorite features of Sign

• Banking-tailored processes, workflows, document archiving, and support

• Out-of-the-box and custom rules-based workflows automate tasks to team members in a logical flow

• Standardize, automate, and control critical operational processes

• Automated routing with alerts and email notifications to keep the process moving efficiently across your organization

• Automated archival and enhanced audit trail ensure compliance

• Real-time business intelligence dashboard provides actionable insights into signing activity, channel performance, and operational trends to optimize workflows

KINECTIVE SIGN™

A better way to sign.

Meet banking’s favorite eSignature solution, Kinective Sign™ (formerly IMM eSign). Trusted by hundreds of banks and credit unions to power millions of transactions monthly, Sign provides an easy-to-use eSignature experience for consumers.

• Convenient and easy document signing from anywhere and any device (both remote and in-branch!)

• Integrated with virtually every business and core system

• Automatic indexing with any imaging solution

• Eliminates risk of incomplete or inaccurate signings

• Designed and priced exclusively for financial institutions

• Real-time business intelligence dashboard delivers insights into signing activity and operational trends to optimize workflows

KINECTIVE SIGN™

A better way to sign.

Meet banking’s favorite eSignature solution, Kinective Sign™ (formerly IMM eSign). Trusted by hundreds of banks and credit unions to power millions of transactions monthly, Sign provides an easy-to-use eSignature experience for consumers.

• Convenient and easy document signing from anywhere and any device (both remote and in-branch!)

• Integrated with virtually every business and core system

• Automatic indexing with any imaging solution

• Eliminates risk of incomplete or inaccurate signings

• Designed and priced exclusively for financial institutions

• Real-time business intelligence dashboard delivers insights into signing activity to optimize workflows

KINECTIVE DIGITAL NOTARY

Eliminate traditional notarization bottlenecks.

Today’s financial institutions still face a major bottleneck in their digital transformation: traditional notarization. This archaic, paper-based process forces banks and credit unions to rely on outdated methods to complete essential processes, requiring the inconvenient coordination of in-house schedules that ultimately slows down operations and transactions. Transform notarizations into a secure, efficient and fully electronic experience with Kinective Digital Notary.

- Streamline essential banking processes with remote online notarization (RON) and in-person electronic notarization (IPEN) solutions

- Enhance customer experience by offering convenient, anytime, anywhere notarization that meets modern expectations

- Improve operational efficiency, reduce costs, accelerate transactions and cut closing times

- Strengthen compliance and auditability with robust identity verification, tamper-evident documents, and comprehensive audit trails.

- Generate new fee income on every loan that requires notarization

KINECTIVE DIGITAL NOTARY

Eliminate traditional notarization bottlenecks.

Today’s financial institutions still face a major bottleneck in their digital transformation: traditional notarization. This archaic, paper-based process forces banks and credit unions to rely on outdated methods to complete essential processes, requiring the inconvenient coordination of in-house schedules that ultimately slows down operations and transactions. Transform notarizations into a secure, efficient and fully electronic experience with Kinective Digital Notary.

- Streamline essential banking processes with remote online notarization (RON) and in-person electronic notarization (IPEN) solutions

- Enhance customer experience by offering convenient, anytime, anywhere notarization that meets modern expectations

- Improve operational efficiency, reduce costs, accelerate transactions and cut closing times

- Strengthen compliance and auditability with robust identity verification, tamper-evident documents, and comprehensive audit trails.

- Generate new fee income on every loan that requires notarization

100% FOCUSED ON BANKING

No need to teach us your business or the outcomes you desire.

With more than 2500 financial institutions currently using our solutions, we have learned the “in’s and out’s” of banking operations, departments, regulations, and overall business environments. We use that knowledge not only to guide the development of our solution and its functionality – but more importantly, we use that subject matter expertise to facilitate our onboarding projects and our ongoing customer service and support.

No other eSign solution offers this level of focused solution and service to the financial services community.

Over 4,000 banks, credit unions, and fintechs choose us.

We were doing so much manual work before, and everything took extra time for our bankers. Now with SignPlus, all our documents go straight to Director automatically, which saves our team a tremendous amount of time. Creating templates is so easy, and the banking expertise and level of support has been hugely beneficial for us—there hasn’t been any delay when we need help.

Kinective Data Intelligence quickly proved its value as an adaptable data warehouse. It expertly ingested and activated our growing data sets, becoming the backbone for mission-critical use cases while eliminating integration bottlenecks and relieving our team’s heavy manual workloads.

Automating incentive tracking has freed up 480 hours per year, letting our management staff focus on coaching and strategy instead of those manual spreadsheets. And as we implement automation for the 5300 call report, we’ll save another 80 hours annually, redirecting time toward analysis and decision making.

Kinective’s Cash Automation solution has eliminated costly dual-entry while empowering our team to focus on high-value advisory conversations instead of time-consuming manual tasks. Their seamless Silverlake integration ensures we deliver exceptional retail experiences every time.