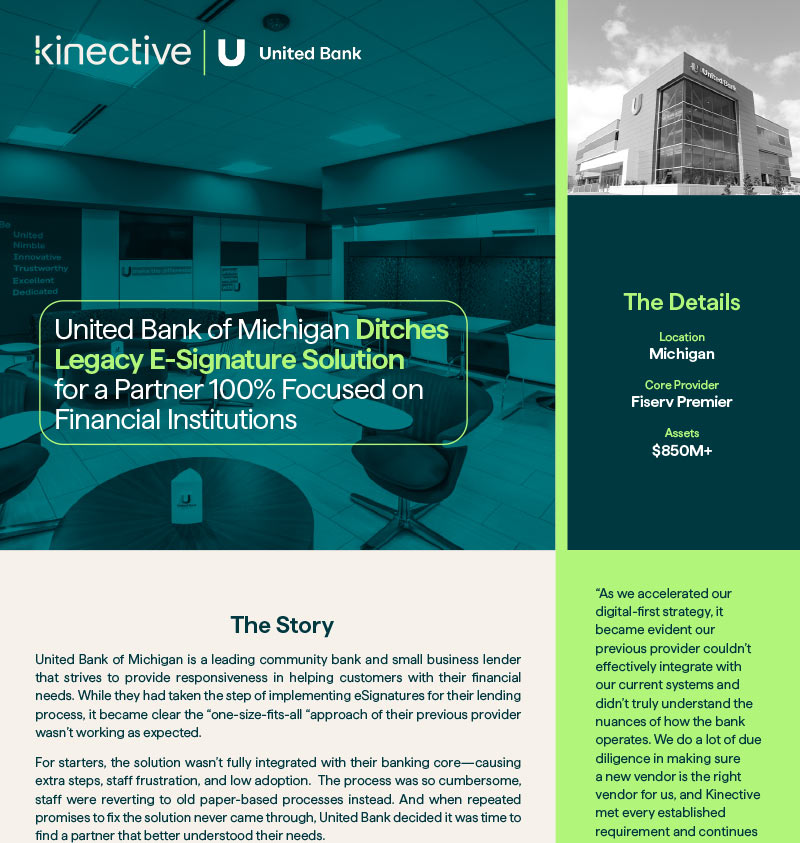

UNITED BANK OF MICHIGAN CASE STUDY

United Bank ditches legacy eSignature solution for a partner 100% focused on financial institutions.

The Story

United Bank of Michigan is a leading community bank and small business lender that strives to provide responsiveness in helping customers with their financial needs. While they had taken the step of implementing eSignatures for their lending process, it became clear the “one-size-fits-all“ approach of their previous provider wasn’t working as expected.

100%

paperless process

Complete

integration to Fiserv

100%

ROI

The Results

United Bank sought out a true banking partner who was two steps ahead of the operational nuances specific to banking—not a generalized offering made for all types of companies. Even more important was a solution that was fully integrated and could make staff lives easier, not more complicated.

Upon implementing Kinective’s Document Automation solution, IMMeSign Plus, the team witnessed immediate and transformative results. They gained the capacity to expedite and enhance transaction processing in a paperless environment, delivering an enriched and engaging experience to customers whether they were remote or in-person.

Now, customers can now electronically sign documents at a place and time of their choosing. And when in-branch, United Bank also leverages tablets equipped with IMMesign Plus for customers to view and electronically sign documents directly on the tablet itself. Not only does this provide a dynamic customer experience, but it also automates all the back-office processes too!

A consistent experience was also important to United Bank, and eSign Plus enables staff to complete transaction in a completely digital environment. So, no matter what business system employees are producing documents from, or what system clients are signing documents with, the user experience is consistent, easy, and fast.

Transactions are completed with just a few clicks, indexing and archival of documents is completely automated, and customers electronically receive all documents with a click of a few buttons. The exceptional experience United Bank was looking for was fully realized!

Products Used

Document Automation

Download the United Bank case study.

United Bank sought out a true banking partner who was two steps ahead of the operational nuances specific to banking—not a generalized offering made for all types of companies. Even more important was a solution that was fully integrated and could make staff lives easier, not more complicated.