ROXBORO SAVINGS BANK CASE STUDY

Consistent confidence in regulatory exams with the help of OmniLytics.

The Story

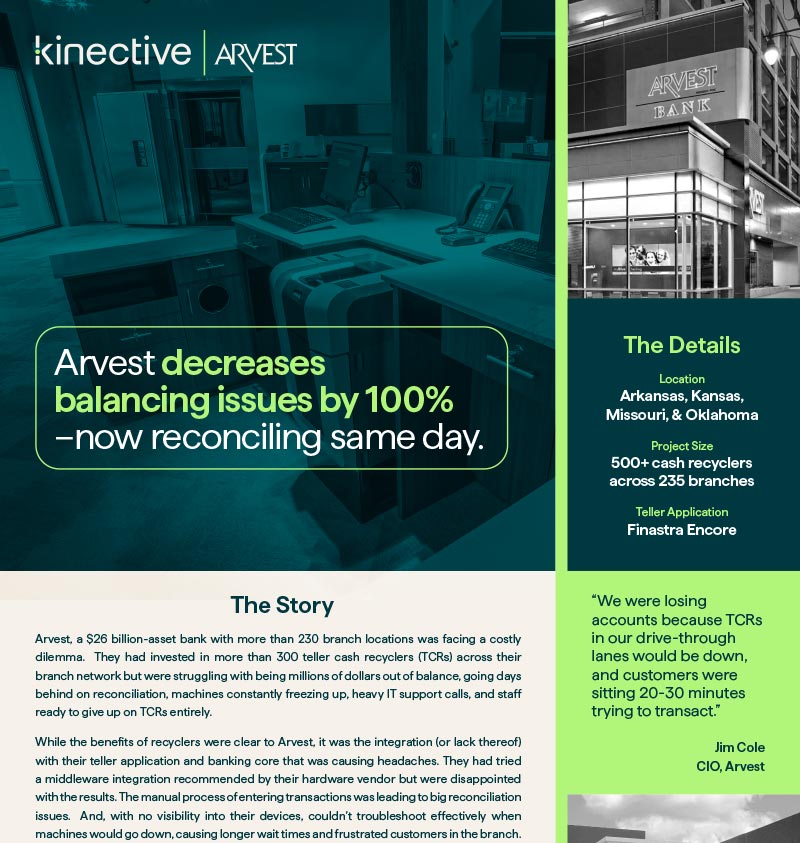

Roxboro Savings Bank, a $300 million-asset bank, has been a staple in their North Carolina community for over 100 years. Like all financial institutions, Roxboro consistently plans and prepares for Regulatory Exams by their governing bodies. Their small team was managing audits, board preparation, and regulatory exam preparations in-house with no outside resources. As years went on, and they began getting suggestions for new implementations, Roxboro Savings Bank decided to look into outside assistance.

10/10

20+

The Results

Roxboro Savings Bank came to Kinective with a specific need – to drastically enhance the way they prepared and performed their regulatory exams, audits, and board communication. To do so, they would need a partner who was just as invested in them as their own in-house team.

They decided to use Omnilytics, Kinective’s interest rate risk measurement and reporting service. This suite of services empowered Roxboro Savings Bank to model, analyze, and forecast interest rate risk, run assumption stress tests and liquidity risk analysis, and work directly with a seasoned OmniLytics team member to run through analysis and support wherever needed. Preparation for the regulatory exams and learning how to most effectively speak to their models in front of the examiners was a game-changing service for Roxboro.

In the 20 years Kinective has worked with Roxboro Savings Bank, the communication and teamwork has remained consistent. Because Roxboro knows they can expect their Regulatory Exam every 18 months, they loop Kinective in once a quarter to ensure all reporting and forecasting is accurate, and then begin engaging more intensely in the month prior to the exam.

The impact has been so noteworthy that in October 2022 they received zero follow up questions during their exam due to their level of preparedness and ability to back up their forecasting. Roxboro’s ability to confidently approach Regulatory Exams with the support and long-term partnership of Kinective, has been a huge win for this community-focused bank.

Products Used

Data & Analytics

Download the Roxboro case study.

Roxboro Savings Bank came to Kinective with a specific need – to drastically enhance the way they prepared and performed their regulatory exams, audits, and board communication.