ARVEST BANK CASE STUDY

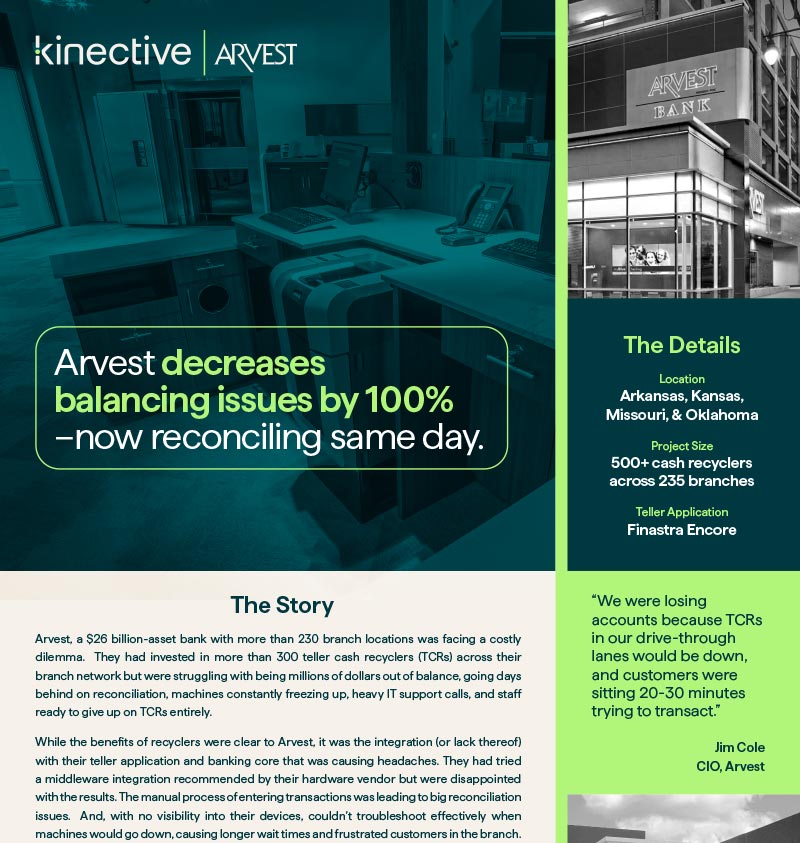

Arvest decreases balancing issues by 100%—now reconciling same day.

The Story

Arvest, a $26 billion-asset bank with more than 230 branch locations was facing a costly dilemma. They had invested in more than 300 teller cash recyclers (TCRs) across their branch network but were struggling with being millions of dollars out of balance, going days behind on reconciliation, machines constantly freezing up, heavy IT support calls, and staff ready to give up on TCRs entirely.

0

balancing issues

500+

recyclers integrated

1000s

The Results

Arvest came to Kinective with a huge request—bring to life an effective integration aligned to their tech and retail strategy. Most importantly, it needed to drive hundreds of cash recyclers with no hiccups, added steps, or extra balancing tasks.

Kinective worked closely with Finastra and Arvest to methodically build the integration. Pilot branches were tested to perfect the roll out process and ensure the integration was100% perfect before launching. And, through all this upfront preparation, the entire large-scale branch roll out went live over one weekend without any issues. Literally, not one call or email was made for a support request!

Since the implementation, branch feedback has been extremely positive. Arvest’s TCRs are finally working as expected, with downtimes nearly eliminated.

In fact, the process has gone so well that Arvest added an additional 200+ recyclers to their fleet! Kinective’s iQ analytics solution provided the device health monitoring and visibility needed to troubleshoot machines before breaking down, along with providing step-by-step error handling instructions so branch staff can fix issues quickly on their own.

Even more exciting? Because teller transactions are now tracked automatically, Arvest’s balancing and reconciliation is now complete the same day versus being days and millions of dollars out of balance with their previous solution. With the time savings, cost savings, and process improvement savings, this deployment has been a huge win for one of the biggest banks in the country.

Products Used

Branch Workflow

Data & Analytics

Download the Arvest case study.

Arvest came to Kinective with a huge request—bring to life an effective integration aligned to their tech and retail strategy. Most importantly, it needed to drive hundreds of cash recyclers with no hiccups, added steps, or extra balancing tasks. Spoiler alert- we knocked it out of the park.