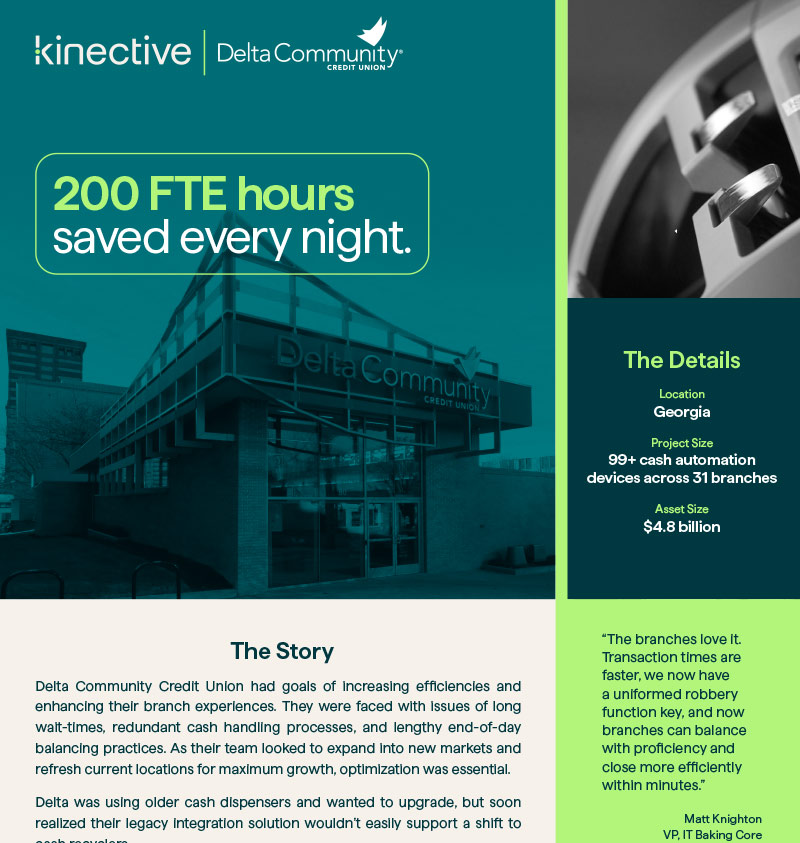

DELTA COMMUNITY CU CASE STUDY

200 FTE hours saved every night.

The Story

Delta Community Credit Union had goals of increasing efficiencies and enhancing their branch experiences. They were faced with issues of long wait-times, redundant cash handling processes, and lengthy end-of-day balancing practices. As their team looked to expand into new markets and refresh current locations for maximum growth, optimization was essential.

75%

reduction in EOD balancing time

16,516 hrs

saved EOD balancing annually

$250K

per year in FTE savings

The Results

For Delta, providing great service starts with staff quickly serving members. With Kinective’s S4 integration, transaction times were cut down considerably (even with the transition to new technology!). Plus, end-of-day balancing and reconciliation was cut down by at least 20 minutes. Multiply that across 31 branches, every single night—and you’ve got massive savings!

Even better, RTA allows their front-desk staff, Member Service Associates, and leaders to step in during busier times, to pull members out of line and process transactions from their individual workstations. This provides that unique “Delta experience” they were looking for while opening the door to more advisory conversations.

The cherry on top has been the data analytics and visibility iQ provides. This allows Delta to track usage and health metrics month over month to help justify ROI and show that the machines are performing optimally. Delta has even been able to spot machines not being used and repurpose to other branches during the supply chain issues post-pandemic.

Products Used

Branch Workflow

Data & Analytics

Download the Delta Community case study.